IBAS (Innovative Banking and Attractive Solutions) as a financial institution has already proven its success. For less than 2 years of operation, IBAS alone has digitized about 1,800 payment points, in addition to less than 7,000 in all of Kosovo, digitized by the entire banking sector, together. This process will continue until the full digitization of the payment market. For about a year since the launch of loans for payments, IBAS has received and examined close to 3,000 applications and has financed a significant number of them. It has been valued at 25.6 million euros by international “Merge & Acquisitions” experts based in Brussels, and has clear goals and a well-founded business plan to quintuple this value within the next 3-5 years. Finally, it is developing the technology that enables the realization of digital payments without a card, without a smartphone, without a smart watch, without biometric signs and without funds, if this is necessary, and for this, it has submitted an international patent application in London.

What is IBAS?

IBAS is a financial institution licensed by the Central Bank of Kosovo for the issuance of electronic money and lending for payments. Such institutions, around the world, are also known as Digital Banks (English Digital Bank) or Neobanks, which mean the provision of significant banking services, through online technology and not through physical offices or traditional branches.

IBAS today and tomorrow?

IBAS today offers the service of digital payments between the payer and the payee. As an effective and efficient alternative to payments through bank cards and traditional POS, IBAS has developed the latest technology that enables the smartphone to play the role of the card, while the QR code, placed on a paper, on a smartphone, or on a computer to play the role of POS. For payment receivers who are not IBAS customers, they can accept payments in any bank account, local or international. For those in need, IBAS offers loans for payments up to 100,000 euros, with a record review period and treatment flexibility.

Tomorrow, IBAS will offer the service of HCE or Google Pay and Apple Pay that enables the connection of any Mastercard and Visa card with your phone in order to make the payment in any store in the world. In addition, it will also offer international bank accounts (IBAN) (of the United Kingdom or the European Union), offering its customers all the privileges and benefits of such accounts, including accepting payments from PayPal and similar platforms and transferring money or remittances, such as within the EU and the UK.

Where does IBAS operate?

Currently IBAS operates in the Republic of Kosovo and within 3-5 years will start operating in Albania, North Macedonia, Montenegro and Bosnia.

What do I earn if I invest in IBAS?

From the first day of your capital increase approval from the Central Bank of Kosovo from your investment, you are entitled to dividends from the day you acquire shareholder status. Of course, as with any other business, annual performance depends on many factors that affect annual profits/losses. However, IBAS has developed highly effective methodologies for managing such fluctuations. On the other hand, in addition to the profits from the dividend, you are also expected to earn with the increase in the financial value of IBAS.

How and when can I invest in IBAS?

In accordance with Article 10 of the IBAS charter approved by the Central Bank and the Business Registration Agency at the Ministry of Industry, Enterprise and Trade, and the Law on Commercial Companies, IBAS has issued 8,000 series A preferential shares in the monetary amount of 400,000 Euros. . The price per share is 50.00 euros.

You can buy these shares, or part of them, by visiting and following the instructions on this path: www.ibas.world/shares

The minimum investment amount is 5,000 euros.

After applying for the purchase of shares and sending the documents, you will be invited for further discussions with the management of IBAS, the contract will be signed and then the relevant documentation will be forwarded to the Central Bank of Kosovo for review and approval. This period can last up to 3 months.

Attention:

No issued shares will be transferred under the ownership of the buyer if the same is ineligible, according to the legislation in force of the Central Bank of Kosovo, or has a criminal past or is suspected of having a criminal past and if the same fails to document the origin of legal money, according to the request of the Central Bank of Kosovo and has not completed the full payment of the shares.

Support:

If you need support or other information, direct your request to shares@ibas.world and you will receive an answer within a day.

Can I sell my shares in IBAS?

Yes, each holder of preferential shares can sell the shares to IBAS sh.a. or resell them to any party that qualifies as appropriate, according to applicable legislation. This was preceded by the notification to IBAS, for a period not less than three (3) months, in order to evaluate the price of the shares and develop the sale procedures. The sale of shares by the shareholder will only occur if the parties agree on the market price. Otherwise, the shares remain owned by the holder of the preferred shares. The re-initiation of the sales process can only happen 3 (three) months after the preliminary initiation.

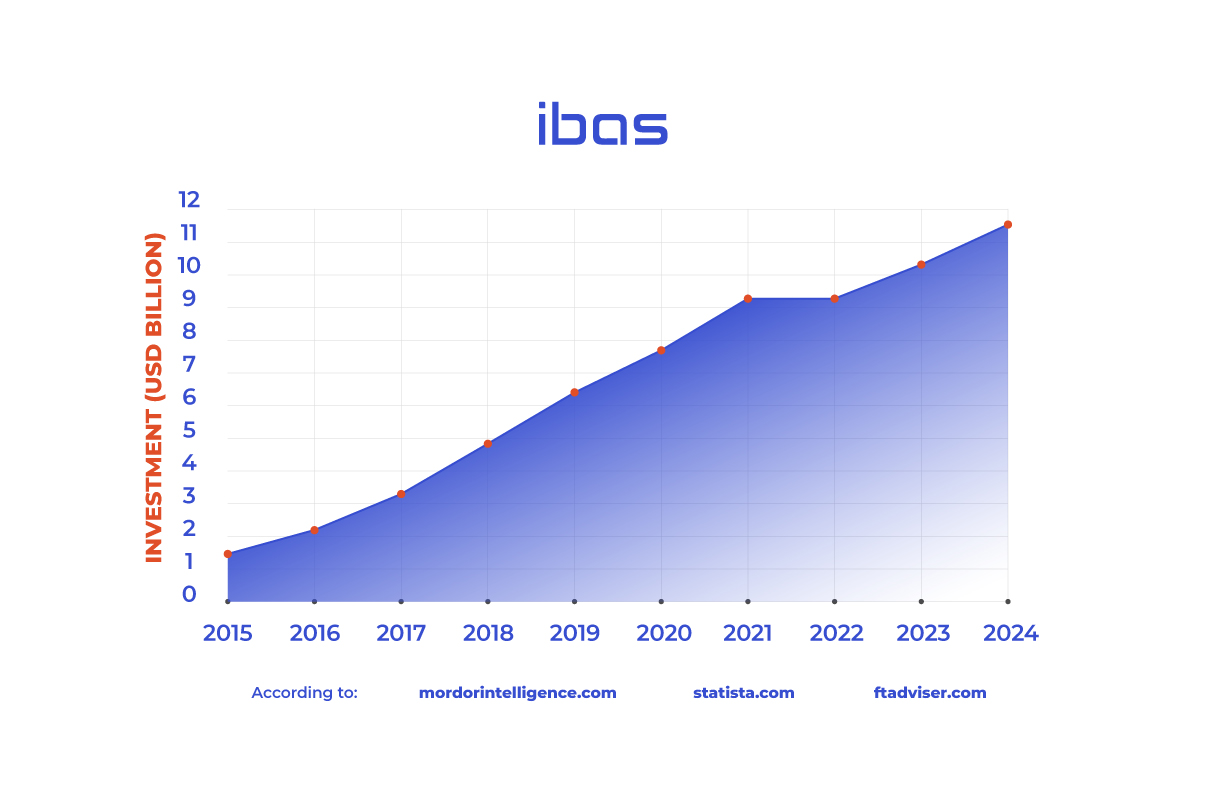

Success stories for institutions like IBAS

In recent years, the digitalization of the financial industry, especially the banking sector, has taken a very dynamic leap and has successfully managed to create a new era. All this with the aim of eliminating barriers in this industry and maintaining and increasing the benefits of physical and legal citizens. In the wake of this, the European Union has issued various legal norms, one of the most important of which is PSD (Payment Service Directive) 2, which,among other things, it defines the security conditions and obligates the electronic interconnection of financial institutions among themselves, in order to provide PIS (Payment Initiation Service) and AIS (Account Information Service), functions that enable customers of a financial institution to perform transactions with another institution’s technology. Most countries that are not part of the European Union have enacted similar laws and/or regulations to create a legal environment similar to that of PSD2. From this legal and technological spirit and from the attractiveness of the industry, many institutions have been developed, and some of the most popular are: Monzo, which operates in England and is valued at 4.5 billion dollars; Starling, which operates in England and is valued at $3.4 billion; N26, which operates in the European Union and is valued at $9 billion; Revolut, which operates in the European Union and England and is valued at 33 billion; Swish payment based in Sweden and Viva wallet based in Greece, which after a gradual investment of 900 million with a coefficient of 9 has sold 49% to JP Morgan. We remind you that none of these institutions, despite the capacities they have, enable the realization of digital payments without a card, without a smart phone, without a smart watch, without biometric signs, as IBAS will do.