Publications

Welcome to the Publications page. This dedicated section serves as a platform to keep the public informed about official statements, insightful blogs, the latest news, and authorized communications endorsed by our management.

IBAS J.S.C. Appoints New Director of Finance and Operations

IBAS J.S.C. announces that it has recruited and selected Mr. Egzon Hoxha for the position of Director of Finance and Operations, an appointment that has been officially approved by the Central Bank of the Republic of Kosovo (CBK), in full compliance with the applicable legal and regulatory framework.

The CBK’s approval was granted following a review of the documentation submitted by IBAS and an assessment of the fulfillment of the legal, professional, and integrity criteria, in accordance with Law No. 04/L-093 on Banks, Microfinance Institutions and Non-Bank Financial Institutions, as well as the relevant regulations governing the approval of senior management.

Mr. Egzon Hoxha brings over 10 years of experience in the financial industry, built through a progressive career that includes both operational positions and senior management roles — from cashier to Finance Director and Deputy Director. This extensive background has equipped him with practical and holistic expertise essential for the sustainable financial and operational management of a non-bank financial institution.

From an academic perspective, Mr. Hoxha has completed his Bachelor’s studies in Accounting and is currently in the final stage of his Master’s studies in Banking and Finance, combining practical experience with a strong theoretical and analytical foundation.

This appointment represents an important step in strengthening IBAS’s financial stability and corporate governance, enhancing financial management capacities, internal control, and operational efficiency. Through this engagement, IBAS aims to further consolidate the trust of its clients, partners, and supervisory institutions.

IBAS J.S.C. remains committed to transparency, regulatory compliance, and the highest professional standards, while continuing to build a sustainable, reliable, and long-term development–oriented financial institution.

We wish Mr. Egzon Hoxha great success in the performance of his new duties and believe that his contribution will have a direct impact on strengthening institutional trust and the financial stability of IBAS.

IBAS Honored by the Faculty of Economics, University of ‘Hasan Prishtina’

IBAS has been awarded a certificate of appreciation by the University of Prishtina – Faculty of Economics, in recognition of its institutional and academic contribution to improving quality, supporting the reaccreditation process, and the continuous development of study programs.

This recognition represents an important acknowledgment of IBAS’s professional commitment to supporting the Faculty of Economics, particularly in the development and strengthening of academic infrastructure, as well as in the renovation and functional improvement of the Student Information Office. Through this contribution, better conditions have been created for student reception, guidance, and the delivery of quality services, while also enhancing institutional communication within the faculty.

IBAS remains committed to supporting higher education institutions, promoting academic quality, and building long-term partnerships that contribute to professional development and the enhancement of students’ academic experience.

REAL BLACK FRIDAY. 1,000 EUROS – ZERO INTEREST FOR 12 MONTHS. TRANSFERS FROM EUROPE WITHOUT FEES. FREE HOSPITAL HEALTH INSURANCE

Black Friday is usually associated with TVs, phones, and home appliances. This year, IBAS turns Black Friday into a financial opportunity for you and your family: with the INTEGRA Account, you benefit from 1,000 EUROS WITH ZERO INTEREST for 12 months, plus many other advantages that make everyday life easier.

What is the INTEGRA Account?

The INTEGRA Account is IBAS’s advanced account, created for people who want more freedom, security, and convenience in managing their finances. With INTEGRA, you get access to complete digital banking services, fast transfers from the diaspora, hospital health insurance, and a Mastercard debit card for payments anywhere in the world.

During the Black Friday campaign, the INTEGRA Account comes with even more favorable conditions, making it the ideal moment to open one.

What do you get with the Black Friday offer?

1,000 EUROS WITH ZERO INTEREST FOR 12 MONTHS

With the INTEGRA Account, you automatically receive a 1,000-euro interest-free credit for 12 months.

This means you can make your most important purchases now—home appliances, travel, or anything else—and pay them off over an entire year with no interest cost. You manage the payments yourself, directly from the IBAS app.

3 transfers per month from Europe, WITH NO FEE

Do you have family or friends in the EU who send you money? With INTEGRA, you benefit from 3 free transfers per month from Europe, without any fees. The money arrives within seconds.

3 cash withdrawals per month, WITH NO FEE, from any ATM in Kosovo

Digital money is convenient, but sometimes you need cash. With this offer:

- You can make 3 withdrawals per month without fees,

- From any ATM in Kosovo, regardless of the bank.

- Choose the nearest ATM—no extra charges.

FREE Hospital Health Insurance up to 25,000 Euros

Health is your greatest asset. With the INTEGRA Account, you get hospital health insurance up to 25,000 euros, completely FREE from IBAS.

This insurance provides financial support in case of hospitalization, saving you from unexpected expenses and offering peace of mind for you and your family.

FREE Mastercard

With INTEGRA, you also get a free Mastercard debit card for payments:

- At POS terminals in all stores in Kosovo and abroad,

- For online purchases,

- For travel bookings, hotels, and other services.

The card is directly linked to your IBAS account and easily managed through the app.

How do you get this offer?

It’s very simple to join this Black Friday offer:

- Download the IBAS app from the App Store or Google Play.

- Create your account and verify your identity in just a few minutes.

- Choose the INTEGRA Account and upload the required documents.

Once your account is approved, the interest-free credit is automatically activated, and you can start making payments via the IBAS app or with your IBAS Mastercard.

Everything is done from your phone—no queues, no paperwork, no physical visits.

Why is now the right moment?

- Because this is a limited Black Friday offer.

- Because it combines interest-free credit, zero-fee transfers, free withdrawals, free health insurance, and a free Mastercard—all in one account, something no one else offers.

- Because IBAS is with you 24/7, directly from the app.

Ready for INTEGRA? If yes, tap this link: https://ibas.world/join-ibas/

IBAS strengthens its governance and strategic leadership with the approval of its CEO by the Central Bank of Kosovo

The Central Bank of Kosovo has approved the appointment of Mr. Gazmend Selmani as the Chief Executive Officer (CEO) of IBAS J.S.C.

Mr. Selmani, founder and co-investor of IBAS, has played a continuous and pivotal role since the institution’s establishment.

In the early stages, he acted as the architect behind the company’s technological framework, and over the past two years, he has chaired the Strategy and Innovation Committee, driving the development of new solutions and empowering IBAS teams in all aspects of growth and innovation.

Mr. Selmani brings over two decades of experience in entrepreneurship and management.

He is widely recognized for his innovative mindset and strategic leadership that have shaped the growth of several successful ventures across the technology, education, and finance sectors.

He holds a Master’s degree in Leadership and Strategic Management (MSc), accredited to UK Level 7 Higher Education standards, and an MBA earned in England.

These accomplishments and professional attributes have earned the confidence of the shareholders, the Board of Directors, and the IBAS team that, under Mr. Selmani’s leadership, the company will continue to advance successfully in its journey of development, innovation, and internationalization.

“I sincerely thank the IBAS Board for the trust placed in me. Under my leadership, IBAS will focus on four key pillars:

(1) transforming IBAS into a virtual Financial HUB,

(2) enhancing competitiveness and advancing the customer experience through innovative products and solutions,

(3) the internationalization of IBAS – starting with its launch in London, England, and progressing towards registration and potential listing on the London Stock Exchange or Nasdaq,

(4) maintaining and strengthening compliance with regulatory requirements.

I believe this is the right moment for IBAS to demonstrate that a financial institution from Kosovo can successfully compete in international markets.”

—Gazmend Selmani, Chief Executive Officer of IBAS

Through this appointment, IBAS reinforces its standing as one of the region’s most innovative financial institutions, moving forward with its vision of becoming an international Financial HUB that bridges European markets with Kosovo.

The institution remains fully committed to transparency, regulatory compliance, and the ongoing enhancement of its services, enabling clients to access modern, efficient, and secure financial solutions.

Your money from Licensed Crypto Exchanges to IBAS — within seconds

IBAS users with verified accounts on licensed European exchanges such as Binance, Bitstamp, ByBit, and others can now enjoy a fast and secure way to move their funds directly to their IBAS SEPA Instant IBAN account, and immediately spend them using the IBAS Mastercard — whether for payments or ATM withdrawals in Kosovo and beyond.

- Open an IBAS Payment Account (IBAN)

Create your IBAN account through the IBAS app and choose between the STANDARD (no maintenance fee), PREMIUM, or INTEGRA packages. - Add Your IBAS IBAN to Binance, Bitstamp, or ByBit

In your eWallet (Binance, Bitstamp, ByBit), register the IBAN account issued by IBAS. - Convert Crypto to FIAT

The conversion from crypto to fiat (EUR) takes place entirely within Binance, Bitstamp, or ByBit. - Transfer via SEPA Instant

Once converted, simply transfer your EUR funds to your IBAS-issued IBAN (UK-based). - Spend or Withdraw Instantly

Use your IBAS Mastercard for:

Payments in stores, online, or POS terminals — in Kosovo and abroad.

Cash withdrawals at any ATM in Kosovo, quickly and hassle-free.

Sending payments to any bank account in Europe via SEPA.

Security and Transparency

Every transaction originating from crypto assets undergoes AML/KYC (Anti-Money Laundering / Know Your Customer) checks, in full compliance with applicable laws.

This ensures that your funds remain secure and the financial system trustworthy.

For every transaction received or made via IBAS, you’ll receive an official payment confirmation, which can be used as proof of payment before public institutions.

Why It’s Worth It

Ultimate Speed – Your funds arrive within seconds through SEPA Instant, ready to use with your IBAS Mastercard.

Total Freedom – Use your Mastercard anywhere in the world, without restrictions.

Complete Trust – Full legal compliance and top-tier security standards.

If you haven’t opened your IBAS account yet, click this link: https://ibas.world/join-ibas/

Start your registration and upgrade your account to STANDARD or any plan that best fits your needs.

IBAS Cashback Program – The Smartest Solution to Boost Your Business Sales

In an increasingly competitive market, your business needs new strategies that drive real sales — not just marketing exposure. IBAS offers exactly that: a structured cashback program where you pay only when sales happen, while IBAS takes care of marketing and offer distribution.

Why Partner with IBAS?

- Customer base – Around 50,000 IBAS clients are potentially your next customers.

- Risk-free marketing – No upfront costs; you only pay for the cashback distributed.

- Guaranteed sales – Every payment is directly tied to a real customer purchase.

- Full transparency – Monthly reports with all purchases, customers, and cashback amounts.

- Long-term loyalty – Customers return to you because they’re rewarded after every purchase.

How It works?

- The customer pays at your business using an IBAS Mastercard.

- The discount you offer is instantly credited by IBAS to the customer’s IBAS account..

- You receive a detailed monthly report of all purchases and cashback given.

- You receive a detailed monthly report of all purchases and cashback given.

Practical example:

- Average annual spending from IBAS clients at your business: €100

- Additional sales generated by IBAS clients: €500,000

- Average net profit margin: 5% = €25,000

- Cashback given to IBAS clients: €10,000 (2%)

- Net remaining profit: €15,000

The example above assumes a 2% cashback rate (although a higher rate is recommended to better motivate buyers).

What does your business gain?

- Increased turnover with no extra marketing expenses.

- Free promotion through IBAS to over 50,000 active customers.

- Guaranteed audience – not just the hope that an ad will be seen.

But that’s not all – collaboration opportunities with IBAS go even further:

In addition to cashback, IBAS offers:

- International SEPA transfers at a flat fee of just €3, regardless of amount.

- BNPL (Buy Now, Pay Later) and instant loans for your customers.

- Financing options for your staff through interest-free credit products.

- Mastercard and bank accounts with no monthly maintenance fees.

- Investor advisory to help attract investments into your business, if needed.

Remember — with IBAS Cashback, you no longer spend money on uncertain marketing.

You pay only when real sales occur, while your customers get rewarded and keep coming back.

Join the IBAS Cashback Program today and become part of a network of partners who grow sales, strengthen customer loyalty, and ensure long-term business success.

Do not pay FEES to send money to Kosovo

One of the most frequently asked questions we get from our friends in the diaspora is: “How can I send money to Kosovo quickly and without fees?” A very reasonable question – who wants to pay when there’s a way to send money to Kosovo WITHOUT FEES? That’s exactly what IBAS provides – a solution no one else offers, making life easier not only for family members in Kosovo but also for diaspora members.

How does IBAS work?

IBAS allows diaspora members to send money directly from their account, from any bank in Europe, to a bank account (IBAN, with SEPA access) that IBAS provides to their family members in Kosovo. This means that sending money from Europe to Kosovo happens just like sending money within Europe – and recipients in Kosovo receive the funds within seconds.

All this is possible for those who have one of the IBAS packages, which provide:

-

Bank account (UK IBAN) with SEPA access, FREE OF CHARGE

-

Mastercard without monthly maintenance fees

-

Withdrawals at any ATM without fees

-

Up to 3 transfers per month from Europe – without fees

-

Up to €1,000 credit interest-free

-

Hospital health insurance FREE up to €25,000

Unbelievable? Here’s how it works:

If you live in a European country, you don’t need to visit bank branches or gas stations to deposit money and send it to Kosovo. You also don’t need to download or install multiple financial apps or manage different bank cards. All you need is for your family member in Kosovo to open an IBAS bank account from home, entirely online – no queues or paperwork.

Once the account is opened, IBAS provides the account number, which can be sent to you via Viber, WhatsApp, Facebook, or any communication channel you use. If they need help, we gladly assist. Then, from your phone or your European bank account, you initiate the transfer to your family member’s IBAS account. The money arrives within seconds. After that, it can be withdrawn at any ATM in Kosovo or spent in stores using the personal IBAS Mastercard we provide.

Does the recipient in Kosovo pay anything?

It depends on the account type chosen. The recipient can select:

-

STANDARD Account: No monthly fee, but pays €3.00 per transfer regardless of the amount received.

-

REMITTANCE + Health Insurance Account: Monthly fee €9.99, includes:

-

2 free transfers per month from Europe

-

Hospital health insurance up to €25,000 free

-

Mastercard without maintenance or fees

-

2 free ATM withdrawals per month in Kosovo

-

-

PREMIUM Account: Monthly fee €9.99, includes:

-

2 free transfers per month from Europe

-

€750 interest-free credit for 3 months

-

Mastercard without maintenance or fees

-

2 free ATM withdrawals per month in Kosovo

-

-

INTEGRA | Family Care Account: Monthly fee €14.99, includes:

-

3 free transfers per month from Europe

-

€1,000 interest-free credit for 30 days

-

Mastercard without maintenance or fees

-

3 free ATM withdrawals per month in Kosovo

-

Hospital health insurance up to €25,000 free

-

Can I upgrade later if I initially open a STANDARD account?

Yes, absolutely! Just press the “Upgrade Account” button in the IBAS app, view all account types, and activate the one you prefer.

Is IBAS safe?

Absolutely. IBAS is a licensed financial institution regulated by the Central Bank of Kosovo, with regular oversight like traditional banks. IBAS has headquarters in Kosovo and the UK, providing access to the SEPA system, monitored by the European Central Bank and the European Commission. We use the latest technology, two-factor authentication (2FA), and biometric verification – just like the most secure banks in Europe.

IBAS – Your financial friend

IBAS is your partner in reducing expenses, ensuring your family’s financial well-being, and providing free health insurance at private hospitals in Kosovo and Albania.

The question is – are you ready to make life easier for yourself and your family in Kosovo? If yes, send them this link: https://ibas.world/join-ibas/ and ask them to install the app and open an IBAS account. Or click the “Press Here” button if they need assistance, and we will guide them step by step. You can also contact us directly at: 038600300 or 048123123, and we will take care of the rest.

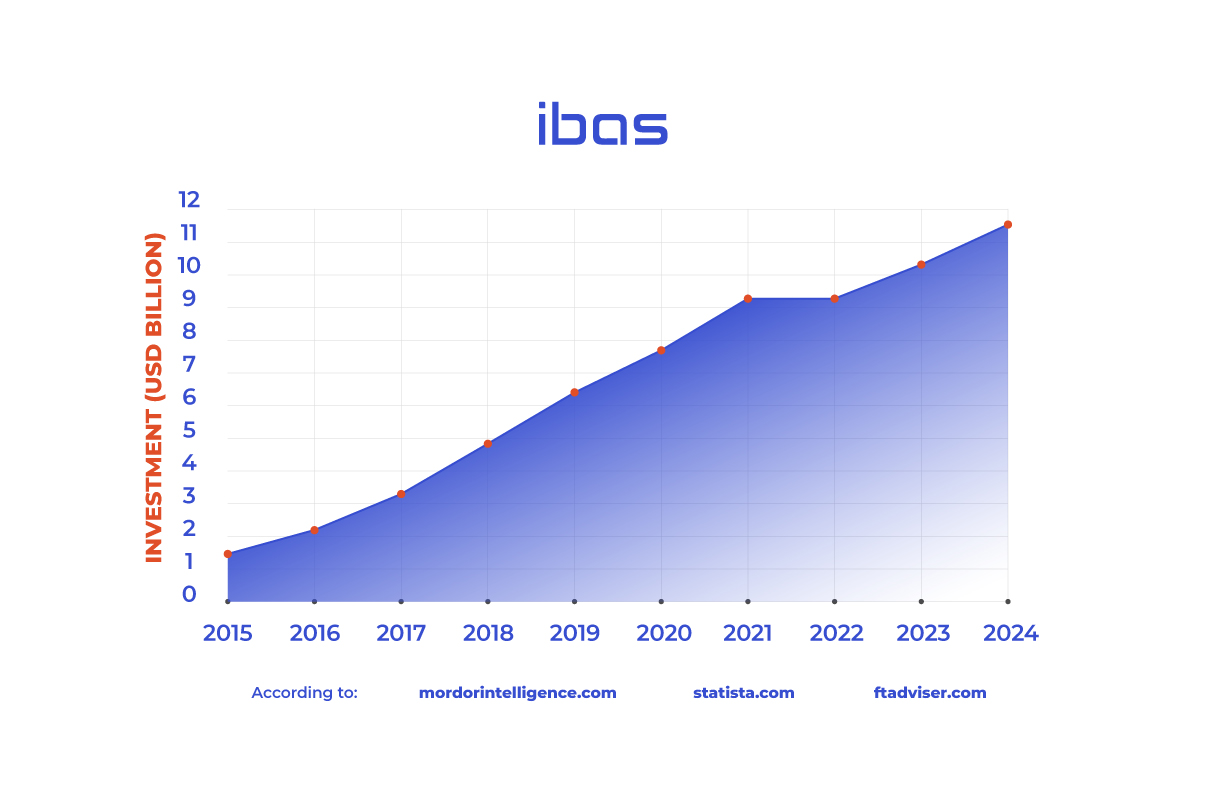

Why Investing in Digital Financial Services is a Winning Strategy

The fintech revolution has transformed the financial sector, creating unparalleled investment opportunities in digital banking and financial services. Investors who recognized the potential early have seen remarkable returns, particularly in markets with strong regulatory frameworks and rapid digital adoption. As financial services continue to shift towards mobile-first, AI-driven, and frictionless experiences, fintech banking service providers are at the forefront of this evolution.

A Thriving Ecosystem for Fintech Growth

One of the world’s most mature fintech markets has set the gold standard for digital banking innovation. The region is home to some of the most successful digital banks, including Revolut, Monzo, and Starling Bank, which have redefined traditional banking by offering seamless, low-cost, and highly personalized financial services.

Several factors have contributed to the phenomenal rise of fintech banking services:

- Progressive Regulatory Environment: A robust yet supportive financial regulatory framework allows fintech firms to experiment and scale. The Financial Conduct Authority (FCA) sandbox has been instrumental in fostering innovation, enabling startups to test financial products before full-scale deployment.

- High Fintech Adoption Rates: Digital banking adoption is among the highest in Europe, with millions of consumers and businesses preferring fintech solutions over traditional banks.

- Investment Magnet: The region has attracted billions in fintech investments, consistently ranking among the top global fintech hubs.

Why Fintech Banking Services are a Smart Investment

The fintech banking sector continues to offer investors substantial growth potential due to several key advantages:

-

Scalability and Cost Efficiency

Unlike traditional banks, fintech banking services operate without costly branch networks, allowing them to scale faster and reach global markets with minimal infrastructure investment. -

Strong Consumer Demand

Younger generations—Millennials and Gen Z—increasingly favor digital-first banking solutions. The shift toward mobile banking, AI-driven financial planning, and embedded finance is only accelerating. -

Acquisition and IPO Potential

Many fintech firms become prime acquisition targets for major financial institutions and global tech giants, offering lucrative exit opportunities for early investors. Others are heading toward IPOs, presenting high-return potential. -

Expansion into Embedded Finance

Fintech banking services are no longer just about deposits and payments. The rise of Buy Now, Pay Later (BNPL), digital lending, and Banking-as-a-Service (BaaS) has expanded fintech’s reach into retail, healthcare, and B2B sectors, creating additional revenue streams.

Case Studies: Investor Returns in Leading Fintech Banks

Early investments in fintech companies like Revolut, Monzo, and Starling Bank have yielded impressive returns:

- Revolut: Founded in 2015, Revolut has experienced exponential growth, with its valuation soaring to $45 billion as of 2024. Early investors who participated in funding rounds through platforms like Crowdcube have seen remarkable returns. For instance, individuals who invested at $2.14 per share in 2016 have witnessed their shares’ value increase to $865.42 per share, representing a 404-fold return on their initial investment. (thetimes.co.uk)

- Monzo: This digital bank has also provided substantial returns for its early backers. Employees and early investors have benefited from significant appreciation in share value, with opportunities to realize profits through secondary share sales. Monzo’s valuation reached £4.5 billion in 2024, reflecting its strong market position and growth trajectory. (techfundingnews.com)

- Starling Bank: While specific figures regarding investor returns are less publicized, Starling has demonstrated consistent profitability and growth. In 2023, the bank reported a pre-tax profit of £195 million, with total revenue reaching £453 million. This financial stability suggests positive outcomes for its investors. (thefinanser.com)

Balancing the Rewards with the Risks

While investing in fintech banking service companies offers high-reward potential, investors must also navigate risks, particularly when investing in equity.

- Regulatory Challenges: Changes in financial regulations can impact fintech firms’ operational models, especially those expanding internationally.

- Market Volatility: Fintech stocks, particularly early-stage startups, can experience sharp valuation swings based on market sentiment and economic conditions.

- Competitive Pressure: With new players entering the market, companies must constantly innovate to maintain a competitive edge.

- Liquidity Risk: Private equity investments in fintech firms often require longer holding periods, with limited short-term exit options.

The Future of Fintech Banking Services is Just Beginning

Fintech banking services have already disrupted traditional finance, but the real opportunity lies ahead as new technologies, AI-driven automation, and embedded finance redefine how people manage money. For investors willing to embrace innovation, strategic risk management, and long-term vision, fintech banking services remain one of the most compelling investment opportunities of the decade.

The question is—are you ready to be part of the next financial revolution?

Everywhere, from Anywhere!

IBAS is the financial institution offering the most attractive and competitive solutions for digital payments. One of the latest services IBAS has introduced is cash delivery straight to your door.

Gone are the days when recipients had to visit a small kiosk — often offering mobile phone repairs, imitation perfumes, or even textiles alongside financial services. With IBAS, that is a thing of the past.

As the only institution offering this service, IBAS has surpassed the reference benchmark of 200 points, reaching 350,000+ locations. Yes, IBAS delivers money to every corner of Kosovo.

All you need is an IBAS payment account with sufficient funds, and IBAS takes care of the rest through authorized partners. You can open your IBAS account remotely by downloading the app here: https://ibas.world/join-ibas/

Receive Money from Anywhere in the World

From the European Economic Area (EEA):

IBAS is the only institution established outside the EU with SEPA access. Clients receive a UK IBAN with SEPA access — with no account opening fees and no maintenance fees.

From Visa or Mastercard:

IBAS is the only institution enabling money transfers through a Payment Link, for senders who want to transfer via Visa or Mastercard from anywhere in the world.

From PayPal (Europe), Stripe, AirBNB, Wise, Revolut, Payoneer, etc.:

IBAS is the only financial institution that allows fee-free transfers for all individual users with FULL, PREMIUM, or INTEGRA accounts from all of the platforms above.

Additionally, qualifying clients can access interest-free credit for payments for up to 3 months. And for INTEGRA account holders, IBAS also provides hospital health insurance coverage up to €25,000 – completely free.

IBAS — your trusted friend, opening every door without showing a card!

Contact us via our website, email, phone, or social media to learn more about all the services we offer!

IBAS closes another successful year!

Throughout 2024, IBAS continued to offer innovative financial services that have transformed the way individuals and businesses manage their finances. With a strong focus on modern technology and digitalization of financial services, IBAS has enabled its clients to benefit from fast, secure, and personalized services, helping them navigate the challenges of financial management with ease.

One of IBAS’s most significant achievements in 2024 was the development and implementation of new financial services that provided clients with fresh opportunities for investment and fund management. By combining advanced technology with efficient and responsive service, IBAS has made high-level financial services accessible and secure for both individuals and businesses. Furthermore, the financial institutions and partners collaborating with IBAS have leveraged these opportunities to increase efficiency and optimize their financial processes.

As 2024 comes to a close, IBAS also continues to offer its fantastic “To Your Door” service:

IBAS remains a leader in providing innovative digital financial services, committed to a future where digitalization and security are at the heart of every transaction. With a strong strategy for the future and a dedicated team focused on the continuous development of financial services, IBAS is well-positioned to continue its growth and expansion in the coming years, solidifying its position as one of the leading players in the digital financial industry.

Why the holiday season feels different with IBAS

The holiday season is a special time, filled with joy, gifts, and cherished moments with loved ones. However, for many, budget constraints can limit festive plans. This is where IBAS Partner Loans come in, offering fast and flexible financing to support your holiday purchases

1. Ease of Holiday Financing

IBAS provides quick, stress-free financing for your festive shopping, allowing you to pay in installments for gifts, home appliances, and other holiday expenses — making the season easier and more enjoyable.

2. Celebrate Without Financial Limits

With IBAS Partner Loans, you can plan and make purchases without worrying about immediate expenses, giving you the freedom to celebrate without fear of exceeding your budget.

3. Flexible Options and Simple Process

IBAS offers a fast and straightforward application process, with flexible payment options that let each individual choose the terms and amounts that suit them best.

4. Make Your Ideal Holiday a Reality

Thanks to IBAS loans, anyone can enjoy an unforgettable holiday, regardless of financial situation, and savor every festive moment without financial restrictions.

With IBAS Partner Loans, the holiday season takes on a new meaning: the opportunity to fulfill your wishes, buy gifts worry-free, and bring more joy and possibilities to you and your loved ones.

Refer & Earn with IBAS – How to earn rewards by helping others

IBAS offers an excellent opportunity to earn rewards for every referral. The program is simple: help your friends and family register with IBAS, and for each new client who signs up through you, you’ll earn rewards. The more people you refer, the more you can earn, with rewards based on the loan amount.

Referral Rewards

The rewards you receive for each referral depend on the loan amount the referred client takes:

- €5 for loans from €100 to €500

- €10 for loans from €501 to €1,000

- €15 for loans from €1,001 to €1,500

To claim your rewards, simply help someone open an IBAS account and have them enter your phone number as the referrer. Every time a client you referred takes a loan, you receive the corresponding reward.

This program is a great way to help people around you benefit from IBAS services while also earning rewards for yourself.

IBAS is a flexible platform that allows you to shop in installments and manage your finances more easily.

Download the IBAS app today, refer your friends and family, and start earning rewards with the “Refer & Earn” program!

IBAS opens a magical door for the holiday season

This festive season, IBAS brings you an excellent opportunity to receive financial support to make your holiday wishes come true. The IBAS year-end campaign is designed to encourage both existing and potential clients to apply for loans to purchase gifts from partners, helping them make the holidays truly special. With the theme “Be a Santa this Holiday Season”, the campaign uses the Christmas reindeer as a symbol of strength, linking it to the possibilities offered by IBAS loans to fulfill your festive dreams.

With the support of IBAS, you can make any wish for this holiday season a reality, benefiting from easy and efficient financing options. This is the perfect moment to celebrate, give, and achieve everything you have dreamed of during this time of year.

The holidays are a time when we all want to give our best to those we love. Whether you plan to give a special gift to someone dear or enhance the festive atmosphere at home, IBAS financial services are here to support you and help you make it all happen.

Don’t let budget constraints hold you back from enjoying the holiday season of your dreams. Apply for a loan with IBAS and enjoy a festive period filled with joy and gifts for you and your loved ones.

Apply now and make this holiday season truly special!

No cash, no card – IBAS opens every door!

Have you ever wanted to buy the latest technology, take advantage of travel opportunities, or purchase electronic devices but hesitated due to unnecessary administrative costs? With the “No Cash, No Card – IBAS Opens Every Door” campaign, now is the perfect time to shop and do what you’ve always dreamed of! You can get a loan up to €1,000 with no additional administrative fees and approval within 5 minutes, if you meet the requirements.

This opportunity is designed for those who want to make quick and hassle-free purchases. With this campaign, you can use your loan at IBAS partner stores, offering excellent products and services in technology, tourism, electronics, and many other sectors. No credit card, no cash needed — you can shop and enjoy payment options up to 12 months, making everything easier and more convenient.

What makes this offer even more attractive is the speed and simplicity of the process. Once you apply for the loan, you get immediate approval and can start spending directly at IBAS partners. This way, you can access everything you need — from the latest technology to top-notch services that will enhance your life, thanks to the financial ease IBAS provides.

Don’t miss this opportunity! Get a loan up to €1,000 and spend stress-free.

IBAS opens every door!

Campaign 10/10/10/10: Your chance to win forever!

Do you want to have the latest phone?

The IBAS 10/10/10/10 Campaign is here, bringing you an incredible opportunity to win an iPhone 16 Pro Max every month! Yes, you read that right!

10 iPhone 16 Pro Max devices will be given away over the next 10 months by IBAS, and you could be one of the lucky winners!

Here’s what you need to do to qualify for this rewarding game:

Verify your IBAS account and get a €10 bonus.

To get started, simply verify your IBAS account and receive your €10 bonus immediately! Quick, simple, and hassle-free. With this €10, you can start making payments and qualify for fantastic rewards.

Make 10 bill payments and qualify for the reward game.

Pay 10 bills through IBAS and become part of the reward game. The more bills you pay, the higher your chances of winning!

Win one of 10 iPhone 16 Pro Max devices from IBAS.

Every month, for 10 consecutive months, an iPhone 16 Pro Max will go to one lucky winner! This is your chance to get the latest and most sought-after phone on the market.

Campaign Duration: 10 Months

The 10/10/10/10 campaign will run for 10 months, and each month a potential winner who completes all the steps above can win an iPhone 16 Pro Max. Each month brings a new opportunity to become a winner!

Don’t miss this golden opportunity!

Take all the steps above, verify your account, pay your bills, and become one of the lucky potential winners of an iPhone 16 Pro Max!

Who will be the next winner? It could be you!

IBAS helps SHOPS manage cash flow during the holiday season!

With the holiday season approaching, retailers across Kosovo are preparing for a surge in demand. Black Friday and Christmas sales are expected to bring a significant increase in transactions. However, with higher sales come higher operational costs, and managing cash flow during this busy period can be challenging.

IBAS is committed to helping retailers manage cash flow during the holiday season.

By partnering with IBAS, retailers will have the opportunity to create a fantastic shopping experience for their customers, allowing them to enjoy the holidays with the purchases they want at the best prices, without worrying about payments—IBAS takes care of that, in accordance with the criteria and conditions set by the Central Bank of Kosovo.

With Black Friday just a few days away, e-commerce businesses are encouraged to optimize the customer experience and emphasize secure payment measures, or risk missing the opportunity to boost sales, attract new customers, and increase spending.

Shifting Shopping Habits

Despite the continued popularity of traditional payment methods such as debit and credit cards for holiday shopping, new research from payment platforms highlights a noticeable shift toward alternative payment methods. Increasingly, consumers prefer digital wallets when shopping online during the festive season.

Business experts explain that to capture the most consumer attention on Black Friday, retailers should embrace a wide range of payment options:

“Competition among retailers to be the final shopping destination for consumers has never been greater. Retailers offering multiple payment options and a seamless checkout experience will stand out, attract new audiences, and increase conversion rates.”

Based on this, IBAS has decided to support SHOPS to perform at their best during the HOLIDAYS.

To take advantage of this opportunity, all shops should contact:

📞 +383 38 600 300

📞 +383 49 999 464

Call to potential investors: Invest in government bonds of Kosovo

The Government of Kosovo issues government bonds as a secure and profitable opportunity for investors seeking stable returns on their investments. Bonds issued on September 5, 2024, by the Government have offered a weighted average interest rate of 4.38% for a 10-year period.

Government Bond Issuance Calendar for 2024:

- 5-Year Bond:

– Opening Date: November 12, 2024

– Closing Date: November 13, 2024 - 2-Year Bond:

– Opening Date: December 3, 2024

– Closing Date: December 4, 2024 - 5-Year Bond:

– Opening Date: December 19, 2024

– Closing Date: December 20, 2024

Investing in Kosovo Government Bonds not only provides secure returns but also supports the country’s development. With varying investment durations, these bonds are suitable for any investor seeking safe and long-term returns.

How to Invest?

To take advantage of these opportunities, we invite you to complete the form below with the amount you wish to invest. Our team at IBAS, as licensed investment advisors, will prepare your personalized investment plan. We will conduct the necessary analysis, preparation, and oversight to ensure that your investment aligns with your financial goals.

Don’t miss the chance to secure stable returns while contributing to the development of Kosovo!

Investing in financial instruments: Advantages and Disadvantages

In the financial world, both individuals and businesses often seek ways to grow their capital. One of the most common methods is investing in financial instruments. However, to make the right decision, it is important to understand the advantages and disadvantages of each type of investment.

This publication highlights the key benefits and challenges of investing in the most well-known financial instruments, including bonds, stocks, investment funds, and alternative instruments such as hedge funds and private equity.

1. Bonds

Bonds represent a debt instrument where investors lend money to a corporation, institution, or government in exchange for periodic interest payments and repayment of the principal at maturity.

Advantages:

- Low Risk: Especially for government bonds or secured bonds, the risk is minimal compared to other investments, making them suitable for conservative investors.

- Stable Income: Bonds provide regular interest payments, offering predictable income, often higher than traditional bank deposits.

- Diversification: Including bonds in your portfolio helps balance risk and stabilize returns.

- Resale or Collateral: Bonds are usually tradable on secondary markets or can be used as collateral for other financial products.

Disadvantages:

- Lower Returns: Compared to stocks or alternative funds, bonds generally offer lower returns with a relatively lower risk.

2. Stocks

Stocks represent ownership in a company. By buying shares, you become a shareholder and benefit from company growth and potential dividend payouts.

Advantages:

- High Growth Potential: Stocks can offer high returns, especially in companies with sustainable growth.

- Dividends: Some companies pay dividends, adding to investment income.

- Liquidity: Stock markets usually provide high liquidity, allowing quick buying and selling.

Disadvantages:

- High Risk: Stock values can fluctuate significantly, and investors may lose part or all of their investment if a company fails.

- Time Horizon: Stocks often require a longer-term horizon to realize significant returns, as markets can be volatile in the short term.

3. Investment Funds

Investment funds allow you to invest in a diversified portfolio of stocks, bonds, and other financial instruments, managed by professionals.

Advantages:

- Automatic Diversification: A fund invests in multiple instruments, reducing individual investment risk.

- Professional Management: Managed by experts, allowing you to benefit from their market knowledge.

- Lower Costs: Some funds have lower management fees compared to individual investments.

Disadvantages:

- Management Fees: Some funds may have high fees that reduce net returns.

- Limited Returns: Diversification reduces risk but also limits the potential for very high returns from individual investments.

4. Hedge Funds and Private Equity

These alternative instruments are usually available to institutional investors or high-net-worth individuals. Hedge funds use complex strategies to generate high returns, while private equity focuses on investing in private companies.

Advantages:

- High Potential Returns: These strategies can yield very high returns for investors willing to accept significant risk.

- Advanced Diversification: Hedge fund investors gain access to strategies and instruments unavailable in traditional markets.

Disadvantages:

- High Risk: Use of leverage and complex strategies increases the risk of loss.

- High Fees: Hedge funds often charge high management and performance fees that can reduce profits.

- Limited Liquidity: Many funds have long lock-up periods, restricting immediate access to capital.

IBAS, as a licensed financial institution and investment advisor by the Central Bank of Kosovo, offers a wide range of investment solutions tailored to your financial goals.

To make an informed choice, it is important to:

- Define a clear investment strategy

- Assess your risk tolerance

- Consider your investment time horizon

- Set your financial objectives

If you are interested in investing, complete the form below, and our specialized team will contact you immediately to discuss your investment opportunities and potential returns.

How to earn more than bank deposits?

TWe all want to earn more and maximize our returns as much as possible. Nowadays, there are plenty of opportunities. Some invest in real estate, some in bank deposits, some in treasury bonds, and some in financial markets, specifically in regulated and supervised markets. In this context, let me remind you that, in addition to other licenses, IBAS is licensed by the Central Bank of Kosovo as an Investment Advisor, offering services for buying and selling financial instruments such as stocks, bonds, and commercial papers.

Maximizing Security in Bond Investments

To minimize risks from bond investments, investors choose to invest in regulated and supervised markets, preferring financial instruments like bonds or securities issued through licensed institutions authorized to issue financial instruments.

These institutions issue bonds only if the corporation offering the financing opportunities has sound financial health and meets the criteria set in the country where the bonds or securities are being issued. To enhance investor security, bond issuers often provide collateral. Collateralized bonds are also known as secured bonds or Securitized Bonds.

To issue Securitized Bonds, issuers provide collateral in the form of assets or real estate. Often, these bonds are further secured by licensed institutions and are supported through mechanisms known as Credit Default Swaps (CDS). Some of the institutions offering such protection include investment banks like Barclays, HSBC, Standard Chartered, and financial insurance companies like AIG (American International Group) and Monoline Insurers.

Why Invest with IBAS?

If you want to invest in these opportunities, IBAS has specialized local and international personnel with the expertise and dedication to prepare and supervise your investment plan. Moreover, IBAS advises investing in regulated and supervised financial markets, such as bond issuances in the United States, the United Kingdom, or Western Europe.

If you wish to start a journey like this, please fill out the form below, and our staff will contact you immediately to discuss the investment opportunities and tailor a plan to meet your financial goals.

IBAS gives you STANDARD!

The STANDARD Package at IBAS offers unmatched value, completely free, and is ideal for those who appreciate simple banking processes. Designed for individuals who prefer simplicity, the STANDARD Package is perfect if you rarely use the “Buy Now, Pay Later” option or don’t make frequent transactions. This package provides easy financial management by offering all the essential features without unnecessary complexity.

Enjoy seamless transactions with a British IBAN and access to SEPA, allowing you to send and receive money with over 5,000 banks worldwide. Through the STANDARD Package, you can easily top up your IBAS virtual wallet from a local or international bank, or via Visa and Mastercard. The STANDARD Package also covers payments for public institutions, utility services, and provides flexible options for withdrawals and applying for loans or overdrafts.

Focused on your essential financial needs, the IBAS STANDARD Package makes banking simple and efficient. Experience a worry-free financial journey that perfectly matches your lifestyle and preferences.

Oh, and yes—you can receive your salary whenever you want, without waiting for payday!

IBAS, your trusted financial companion!

Remittances via IBAS – for only €3, regardless of the amount

The Kosovar diaspora in Germany has always maintained a strong connection with their homeland, and sending remittances is one of the main ways to support family and loved ones in Kosovo. However, the traditional process of sending money often requires visiting physical offices, involves high costs, and can be time-consuming and cumbersome.

IBAS, as a financial institution licensed by the Central Bank of Kosovo, offers an innovative solution to simplify this process. You can now send money anytime, anywhere in Germany, without the hassle of traditional procedures.

How It works

Using IBAS is extremely simple. As a SEPA member (Single Euro Payments Area), IBAS allows you to transfer money directly from your bank account in Germany to the recipient’s IBAS account in Kosovo, without visiting physical offices. This service is usually free for the sender, and the funds reach Kosovo within seconds—except in cases where your bank is not part of SEPA Instant. In those cases, the transfer will arrive within one business day.

The Recipient in Kosovo

To receive the funds, the recipient needs an IBAS payment account, which is completely free to open and maintain. By opening an IBAS account, the recipient automatically gets a British bank account with SEPA access. They pay only €3 per transfer, regardless of the amount sent. The process is simple, transparent, and free of hidden fees. If help is needed, IBAS staff assist at no cost.

Benefits for the Diaspora

- No fees for the sender: As a SEPA member, IBAS enables transfers from Germany to Kosovo, usually free of charge, unless your bank’s policy differs from other German banks.

- Send from home: No need to visit offices or agencies; everything is done online from your bank account.

- Fast and secure: Transfers are executed quickly and securely, without delays or complications.

Benefits for the Recipient in Kosovo

- Free account: Opening and maintaining an IBAS account is completely free.

- Low costs: The recipient pays only €3 per transfer, regardless of the amount.

- SEPA access: The IBAS account gives access to the SEPA network, allowing quick and low-cost receipt of remittances.

- Additional services: Recipients can access credit for payments or enjoy PLOT, INTEGRA, or PREMIUM packages, which allow purchases with Buy Now, Pay Later options for up to three months interest-free, among other benefits.

With IBAS, you can support your loved ones in Kosovo in the easiest, cheapest, and safest way. Together, we make it easier for the Kosovar diaspora to care for their homeland.

Kosovo IBAN for Individuals, Businesses, and NGOs

Thanks to advancements in legislation by the Central Bank of Kosovo, IBAS has started issuing international bank account numbers (IBANs) for individuals, businesses, and NGOs. All IBANs issued by IBAS come with no maintenance fees and allow sending and receiving money to any bank account, domestically or internationally.

In addition to the Kosovo bank account, IBAS continues to issue British bank account numbers, giving holders access to SEPA (Single European Payment Area). This enables receiving or sending money to and from Europe within seconds, for a fee of just €3, regardless of the amount.

Moreover, IBAS offers credit or overdraft facilities for payments with repayment terms up to 12 months, as well as a Buy Now, Pay Later (BNPL) model with 0% interest for three (3) months.

These are just some of the innovations and opportunities IBAS provides to its clients. The same dynamic will continue with new developments and attractive solutions for customers.

For those who delay joining, a unique experience may be missed. For you who have decided, this is the gateway: https://ibas.world/join-ibas/ — who knows, IBAS might even have a surprise waiting for you!

Pass-through eWallet: The Next Generation Innovation from IBAS

We’ve all faced inconvenient situations when making a payment to a public or private institution—either we don’t have an electronic payment option, we lack cash on hand, or we don’t have the necessary information to complete the payment via eBanking or mBanking. To eliminate these issues, IBAS introduces the latest technology: Pass-through eWallet—a unique solution not found anywhere else in Kosovo or the Western Balkans.

What exactly is Pass-through eWallet?

In recent years, you may have heard a lot about eWallets or electronic wallets. Traditional eWallets are offered by licensed financial institutions, allowing users to hold electronic money in a payment account. Payments to third parties—public institutions, private entities, or even private individuals—require two steps:

- Preloading the eWallet with funds (either at a physical point, via bank transfer, or using Visa/Mastercard).

- Initiating and confirming the payment to the selected beneficiary.

With IBAS Pass-through eWallet, this traditional method becomes obsolete. Now, the technology allows you to make electronic payments without preloading your eWallet. Payments or transfers can be completed directly from your Visa or Mastercard.

Moreover, thanks to the legal framework provided by Law 03/L-196, you don’t even need to create a digital identity. And that’s not all—if you don’t have funds on your Visa or Mastercard, you can still make payments using one of the three “Buy Now, Pay Later” (BNPL) accounts offered by IBAS.

Experience the Power of Pass-through eWallet

Enjoy the freedom of controlling your finances without the stress of insufficient funds when you need them the most. Visit our website https://ibas.world/join-ibas/ and create your account to make payments at any public institution whenever needed.

Exclusive at IBAS: Get €500 Interest-Free in Seconds!

Have you heard about the latest opportunity IBAS offers its clients? If your credit history is Category A in the Kosovo Credit Register, you are just one click away from receiving €500 interest-free for three months! This is our new advantage with the Buy Now, Pay Later (BNPL) product.

Instant Access – Funds in Your Account Within Seconds!

With IBAS BNPL, you don’t have to wait to access funds. As soon as you start a payment process and your IBAS account balance is insufficient, you’ll see the option to choose one of IBAS’s packages offering up to €500 credit with 0% interest for three months. This allows you to take advantage of current offers or cover urgent expenses without any delay.

How Does This Financial Magic Work?

- Just One Click: Activate the BNPL offer directly from our app.

- Immediate Access: Funds are disbursed to your IBAS account faster than a second.

- Zero Interest: Use €500 for up to three months without paying any interest.

Simple, fast, and secure – IBAS continues to improve the way you manage your finances, giving you the tools to make smart choices with full flexibility. Every transaction is protected by the latest security technology, ensuring complete peace of mind while using these funds as needed.

Don’t miss this golden opportunity! Click to activate your BNPL offer now and start enjoying shopping freedom even without cash. Create and verify your account with IBAS, or open the IBAS app to get €500 interest-free for three months, within a second, with just one click.

Click here to open your IBAS account now – your financial companion!

Global Presence and Visa & Mastercard Payment Gateway – IBAS’ Newest Service

In Kosovo, many businesses have struggled to offer digital payments via Visa and Mastercard due to requirements, delays, and bureaucracy. IBAS aims to eliminate these obstacles. To achieve this, IBAS has developed a web-based virtual store platform and plug-ins compatible with Shopify and WooCommerce. This solution not only allows you to run a virtual store in Kosovo but also gives you access to global markets. With IBAS, you can easily start selling in the U.S., Europe, and beyond.

IBAS transforms rigid and bureaucratic environments into extraordinary business opportunities. From a limited market of 1.5 million residents, IBAS opens the door to a market of over 800 million people and more than 50 million businesses worldwide.

Moreover, IBAS supports you in opening or developing your virtual store, financing supplier payments, and organizing shipping directly to your customers’ addresses. If needed, IBAS can also assist with digital marketing, helping you reach targeted customers in any country around the globe.

So, what are you waiting for? Ready to become a market leader? Fill out your details in the form and let IBAS help you go global!

IBAS and rTrust in the Spotlight at AmCham Expo Space!

IBAS, in close collaboration with rTrust, stood out as a distinguished partner at the AmCham Expo Space event, organized in cooperation with FLORIGallery and Prishtina Mall during the month marking the anniversary of the United States’ Independence.

At the event, IBAS showcased its latest innovation – the electronic signature-enabled credit service, powered by the rTrust platform. This service allows citizens of Kosovo to obtain loans up to €5,000 without needing to visit an IBAS branch physically. All procedures are carried out fully online, using electronic signatures, marking a significant step towards the digital transformation of financial services in Kosovo.

U.S. Ambassador Jeffrey Hovenier

U.S. Ambassador Jeffrey HovenierDuring the event, U.S. Ambassador Mr. Hovenier highlighted the strong economic relations between Kosovar companies and the United States, emphasizing their importance at the expo.

Professionals and Key Figures from Various Sectors Showed Strong Interest in IBAS’ Advanced Services

Attendees had the opportunity to get an up-close look at IBAS’ electronic signature loan service and explore how IBAS can assist in simplifying and improving personal financial management. Through initiatives like this, IBAS continues to pursue its mission of providing innovative and efficient solutions that meet the needs of the Kosovo market and beyond.

The AmCham Expo Space was marked as a great success, highlighting the importance of partnerships and innovations for the advancement of the financial and banking services sector.

IBAS, with its commitment to enhancing the customer experience and integrating new technologies, reaffirms its position as a leader in innovation within the financial industry in Kosovo and beyond.

Launch of New Loans up to €5,000 with Electronic Signature – The Next Legacy from IBAS

IBAS, a leader in financial services innovation, is pleased to announce an extraordinary advancement in the market of Kosovo and the Western Balkans.

Now, the opportunity to obtain loans for payments, up to €5,000, has become even simpler and more accessible thanks to electronic signatures. With this innovation, IBAS clients no longer need to visit any physical IBAS locations; the entire process can be completed remotely, from anywhere.

This bold step marks the first time such an option is offered in the region, reaffirming IBAS’s position as a pioneer in Innovative Banking and Attractive Solutions.

This innovation is powered by rTrust, a trusted eIDAS service provider recognized throughout the European Economic Area and by the Government of Kosovo, marking one of IBAS’s key achievements in the regional financial industry.

The process to obtain this type of loan is simple and involves the following steps:

- Download the IBAS app from the App Store or Play Store and create your account.

- Apply for a loan or overdraft for payments.

- Sign the loan agreement electronically, enabled by rTrust’s latest digital signature technology.

This innovation is brought to you, so don’t hesitate to take advantage of this opportunity that offers more flexibility and efficiency.

Visit our website https://ibas.world/join-ibas/ and experience the freedom that our innovation brings.

IBAS — The most innovative FinTech in Western Balkans stages 59% Growth

We’re thrilled to share some incredible news with our valued customers and partners! 2023 was a phenomenal year for IBAS, marked by a staggering 59% business growth compared to 2022. This exceptional achievement solidifies our position as the most successful fintech institution the Western Balkans.

A Vision Realized

IBAS was born in 2019, fueled by a passionate team with a revolutionary vision: to transform the global financial landscape, starting from our home in Kosovo. Our unwavering dedication led us to secure a license from the Central Bank of Kosovo, establishing us as a premier electronic money issuer and credit provider for payments. We further expanded our license to encompass Investment Advisory services, empowering clients to buy and sell shares, bonds, and convertible bonds.

A brighter financial future

At IBAS, we’re committed to building a brighter financial future — one that prioritizes accessibility, convenience, and efficiency. Our comprehensive financial solutions cater to your every need, encompassing:

- Digital Payments and ePOS: Seamless transactions with British IBAN, SEPA access, ePOS and OR code solutions, debit cards, secure payment gateways, utility bill payments, and hassle—free payments for public institutions.

- International Money Transfers: Effortless transfers to and from over 5,000 European Economic Area banks, convenient transfers from Stripe and Wise, and swift payments for outsourcing platforms like Upwork, Fiverr, PeopleperHour, and TopTal.

- Loans for Payments: We offer a variety of loan options to suit your needs, including loans for payments up to £100,000, overdraft facilities up to £100,000, and a Buy Now Pay Later scheme with three months interest-free.

- Investment Advisory Services: Our expert advisors provide personalized investment plans and guidance, empowering you to make informed decisions about buying and selling financial instruments such as shares, bonds, and commercial receipts.

Thank You!

This remarkable growth wouldn’t be possible without the trust and support of our incredible customers and partners. We’re deeply grateful for your continued partnership and look forward to achieving even greater heights together in 2024 and beyond!

Stay tuned for more exciting announcements as we continue to innovate the future of finance!

Why Your Company Should Issue Bonds

In today’s competitive market, companies are constantly looking for ways to grow. One opportunity to increase capital is through bond issuance. However, until now, this form of financing has not been widely accessible to private businesses in Kosovo due to the absence of capital markets legislation. That said, businesses are still able to issue bonds in Europe, specifically in the UK, where capital markets are regulated and supervised. IBAS, as an institution licensed by the Central Bank of Kosovo as an Investment Advisor, can assist you in this process.

Some of the benefits of issuing bonds include:

- Access to Funds: Issuing bonds provides companies with immediate cash flow without selling shares or losing control of the company. This financing can be used for various purposes, including funding new projects, purchasing goods/services for circulation, expanding facilities or assets, or refinancing existing debt.

- Fixed Interest Payments: Unlike bank loans or other lending instruments, bonds typically come with fixed interest payments. This predictability allows companies to manage cash flow and budgeting more effectively, regardless of interest rate fluctuations.

- Diverse Investor Base: Bonds attract a wide range of investors, including institutional investors, pension funds, and individual investors seeking stable returns. Leveraging this diverse investor base can potentially secure more favorable financing conditions.

- Long-Term Flexibility: Bonds can be issued with a variety of maturities, from short-term bonds (less than one year) to long-term bonds (up to 30 years or more), allowing companies to align financing with project or initiative needs.

- Enhanced Credit Profile: Successful bond issuance can improve a company’s credit profile and overall financial position, potentially resulting in lower borrowing costs in the future and greater access to various capital sources.

Unsecured Bonds

Unsecured bonds, also known as debentures, are not backed by specific assets, unlike secured bonds, which are supported by specific collateral. Investors rely solely on the issuing company’s creditworthiness and reputation.

Advantages of unsecured bonds include:

- Lower Collateral Requirements: Issuing unsecured bonds eliminates the need to pledge specific assets. This is particularly beneficial for companies with limited assets or those seeking to maintain flexibility for future financing.

- Ease for Investors: Unsecured bonds are simpler for investors as they do not require collateral evaluation, which can positively impact bond pricing. However, the issuance depends heavily on the company’s ability to repay.

- Asset Management Flexibility: Companies retain greater flexibility in managing their assets and operations, as financing does not depend on available collateral.

- Building Trust and Reputation: Successfully issuing unsecured bonds demonstrates confidence in the company’s financial strength. This can increase investor trust, foster long-term relationships, and provide ongoing access to capital markets.

Conclusion:

Issuing bonds, especially unsecured bonds, offers an exceptional opportunity for companies to increase capital, diversify their investor base, and strengthen their financial position. By carefully considering the benefits and value proposition of bond issuance, companies can open new paths for growth and innovation while maximizing shareholder value.

If you believe that issuing bonds can enhance your business’s strength and competitiveness, contact us to learn more about these opportunities.

Fill out the form for more information.

Banks, Fintechs, and Businesses: Building Synergies for Accelerating Access to Finance in Kosovo

As the pioneering Fintech company in Kosovo, IBAS, represented by its founder and solution architect, Mr. Gazmend, made a significant impact at an event co-hosted by USAID and the Central Bank of Kosovo. The theme was “Banks, Fintechs, and Businesses: Building Synergies for Accelerating Access to Finance.”

In his presentation, Mr. Gazmend eloquently outlined the unique challenges and opportunities that come with being a forerunner in the fintech space. He delved into the critical role of a supportive ecosystem, which hinges on the collaboration of government entities, regulatory agencies, and financial infrastructures. Notably, he showcased IBAS’s innovative solutions, such as commission-free digital transactions, no-fee SEPA transfers, interest-free options for the ‘Buy Now Pay Later’ scheme, and the eagerly anticipated investment advisory services, all aligned with current regulations.

Mr. Gazmend concluded with a powerful call to action for regulatory bodies and other stakeholders. He urged them to adapt to the evolving landscape shaped by PSD2 regulations and the advent of open banking. Additionally, he advocated for partnerships with governmental organizations to ensure that businesses provide at least one alternative to cash payments.

The IBAS team expressed their heartfelt appreciation for the audience’s acknowledgement and enthusiastic reception of their groundbreaking contributions. They reiterated their dedication to perpetually innovate and enhance value in the fintech domain.