Publications

Welcome to the Publications page. This dedicated section serves as a platform to keep the public informed about official statements, insightful blogs, the latest news, and authorized communications endorsed by our management.

MOS PAGUAJ PROVIZION për me çu pare në Kosovë

Një nga pyetjet më të shpeshta që marrim nga miqtë tanë në mërgatë është: “Qysh me çu pare në Kosovë, shpejt dhe pa provizion?”

Një pyetje shumë me vend – kush ka dëshirë me pagu kur ka mundësi me çu pare në Kosovë, PA PROVIZION? E, saktësisht këtë e bën – me një zgjidhje që askush tjetër nuk e ofron dhe që po ua lehtëson jetën të gjithëve – jo vetëm familjarëve në Kosovë, por edhe mërgimtarëve.

Si funksionon IBAS?

IBAS u mundëson mërgimtarëve të dërgojnë para drejtpërdrejt nga llogaria e tyre, nga cilado bankë në Evropë, në llogarinë bankare (konto numër, me qasje në SEPA) që IBAS ua ofron familjarëve të tyre në Kosovë. Kjo do të thotë që dërgimi i parave nga Evropa në Kosovë ndodh njësoj si brenda vetë Evropës – ndërsa pranuesit në Kosovë i marrin paratë brenda sekondave. Krejt kjo bëhet e mundur për ata që posedojnë njërën nga pakot, përmes së cilave përfitojnë:

- Konto numër (IBAN anglez) me qasje në SEPA, PA PAGESË!

- Mastercard PA KOSTO të mirëmbajtjes mujore.

- Tërheqje në çdo bankomat PA PROVIZION!

- Deri në 3 transfere mujore nga Evropa – PA PROVIZION!

- Deri në 1,000€ kredi PA INTERES!

- Sigurim shëndetësor spitalor, FALAS deri në 25,000€

E pabesueshme? Ja si funksionon

Nëse jeton në një shtet të Evropës, nuk ke nevojë me shku nëpër trafika a pompa benzine për me deponu pare e me i çu në Kosovë. As nuk ke nevojë me shkarku a instalu aplikacione të institucioneve financiare e me u bë kahre me kartela bankare. Krejt çka duhet është, familjarit tënd në Kosovë me i thanë me hapë një llogari bankare në IBAS, prej shpisë, krejt online – pa pasë nevojë me u maltretu nëpër sportele.

Dhe qat konto numër që na ia hapim, me ua çu juve në Viber, WhatsApp, Facebook apo çfarëdo kanali tjetër të komunikimit që e përdorni me fole në mes veti. Nëse ka nevojë me i ndihmu, na me shumë qejf e bëjmë.

E ju, prej telefonit tënd, respektivisht prej llogarisë tënde bankare në Evropë, e nisë transferin në konto numrin e familjarit tënd në IBAS. Paret i mbërrijnë brenda sekondave. Pastaj mundet me i nxjerrë në cilindo bankomat në Kosovë, ose me pagu në dyqane, me kartelën personale të Mastercard që ia lëshojmë na.

Po pranuesi i parave në Kosovë, a paguan diçka?

Varet nga zgjedhja që e bën. Pranuesi mundet me zgjedhë:

- Llogaria STANDARD: Pa pagesë mujore, por që paguan 3.00 euro për çdo transfer, pavarësisht sa e madhe është shuma e pareve që e pranon. Ose:

- Llogarinë REMITENCA + Sigurimi Shëndetësor, që ka mirëmbajtje mujore prej: 9.99 euro, dhe fiton:

- 2 transfere mujore nga Evropa, pa provizion

- Sigurim shëndetësor spitalor deri në 25,000€ pa pagesë

- Mastercard pa mirëmbajtje dhe pa provizion

- 2 tërheqje mujore në çdo bankomat në Kosovë, pa provizion

- Llogarinë PREMIUM, që ka mirëmbajtje mujore prej: 9.99 euro, dhe fiton:

- 2 transfere mujore nga Evropa, pa provizion

- 750€ kredi pa interes për 3 muaj

- Mastercard pa mirëmbajtje dhe pa provizion

- 2 tërheqje mujore në çdo bankomat në Kosovë, pa provizion

- Llogarinë INTEGRA | Kujdesi familjar, që ka mirëmbajtje mujore prej: 14.99 euro, dhe fiton:

- 3 transfere mujore nga Evropa, pa provizion

- 1,000€ kredi pa interes për 30 ditë

- Mastercard pa mirëmbajtje dhe pa provizion

- 3 tërheqje mujore në çdo bankomat në Kosovë, pa provizion

- Sigurim shëndetësor spitalor deri në 25,000€ pa pagesë

Po nëse hap fillimisht llogarinë STANDARD, a mundet me ndërru ma vonë?

Po, absolutisht! Vetëm e shtypë butonin “Avanco llogarinë” në aplikacionin e IBAS dhe i shfaqen të gjitha llojet e llogarive në IBAS dhe e shtypë butonin Aktivizo për llojin e llogarisë që i pëlqen.

E, a është i sigurt IBAS?

Absolutisht po. IBAS është institucion financiar i licencuar nga Banka Qendrore e Kosovës dhe mbikëqyret rregullisht, njësoj si bankat. Selia e IBAS ndodhet në Kosovë dhe në Angli, nga ku ofron qasje në sistemin SEPA, sistem ky i mbikëqyrur nga Banka Qendrore Evropiane dhe Komisioni Evropian.

Përdorim teknologjinë më të fundit, siguri me verifikim me dy faktorë (2FA) dhe shenja biometrike – njësoj si në bankat më të sigurta në Evropë.

IBAS – Shoku yt financiar

IBAS, shoku yt që kujdeset për reduktimin e shpenzimeve të tua, mirëqenien financiare të familjes suaj dhe përfshirjen në sigurimin shëndetësor falas në të gjitha spitalet private në Kosovë dhe Shqipëri.

Pyetja është – a je gati me ia lehtësu jetën vetes dhe familjarëve tu në Kosovë? Nëse po, dërgoja këtë link https://ibas.world/join-ibas/ dhe thuaj ta instalon aplikacionin dhe të hapë llogari në IBAS, ose ta shtypë butonin Shtyp këtu nëse të duhet ndihma, dhe ne e kontaktojmë për udhëzime, hap pas hapi.

Ose, na shkruaj neve në: 038600300 048123123 dhe na merremi me të tjerat.

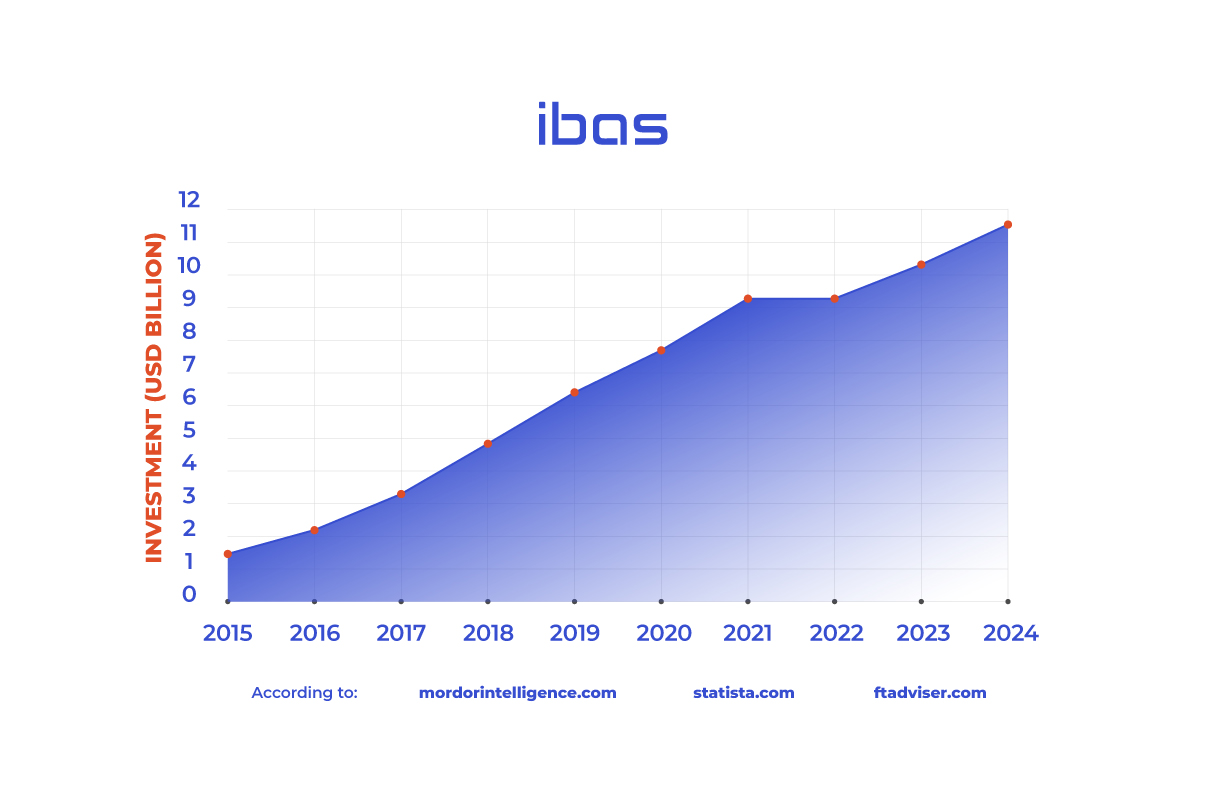

Why Investing in Digital Financial Services is a Winning Strategy

The fintech revolution has transformed the financial sector, creating unparalleled investment opportunities in digital banking and financial services. Investors who recognized the potential early have seen remarkable returns, particularly in markets with strong regulatory frameworks and rapid digital adoption. As financial services continue to shift towards mobile-first, AI-driven, and frictionless experiences, fintech banking service providers are at the forefront of this evolution.

A Thriving Ecosystem for Fintech Growth

One of the world’s most mature fintech markets has set the gold standard for digital banking innovation. The region is home to some of the most successful digital banks, including Revolut, Monzo, and Starling Bank, which have redefined traditional banking by offering seamless, low-cost, and highly personalized financial services.

Several factors have contributed to the phenomenal rise of fintech banking services:

- Progressive Regulatory Environment: A robust yet supportive financial regulatory framework allows fintech firms to experiment and scale. The Financial Conduct Authority (FCA) sandbox has been instrumental in fostering innovation, enabling startups to test financial products before full-scale deployment.

- High Fintech Adoption Rates: Digital banking adoption is among the highest in Europe, with millions of consumers and businesses preferring fintech solutions over traditional banks.

- Investment Magnet: The region has attracted billions in fintech investments, consistently ranking among the top global fintech hubs.

Why Fintech Banking Services are a Smart Investment

The fintech banking sector continues to offer investors substantial growth potential due to several key advantages:

-

Scalability and Cost Efficiency

Unlike traditional banks, fintech banking services operate without costly branch networks, allowing them to scale faster and reach global markets with minimal infrastructure investment. -

Strong Consumer Demand

Younger generations—Millennials and Gen Z—increasingly favor digital-first banking solutions. The shift toward mobile banking, AI-driven financial planning, and embedded finance is only accelerating. -

Acquisition and IPO Potential

Many fintech firms become prime acquisition targets for major financial institutions and global tech giants, offering lucrative exit opportunities for early investors. Others are heading toward IPOs, presenting high-return potential. -

Expansion into Embedded Finance

Fintech banking services are no longer just about deposits and payments. The rise of Buy Now, Pay Later (BNPL), digital lending, and Banking-as-a-Service (BaaS) has expanded fintech’s reach into retail, healthcare, and B2B sectors, creating additional revenue streams.

Case Studies: Investor Returns in Leading Fintech Banks

Early investments in fintech companies like Revolut, Monzo, and Starling Bank have yielded impressive returns:

- Revolut: Founded in 2015, Revolut has experienced exponential growth, with its valuation soaring to $45 billion as of 2024. Early investors who participated in funding rounds through platforms like Crowdcube have seen remarkable returns. For instance, individuals who invested at $2.14 per share in 2016 have witnessed their shares’ value increase to $865.42 per share, representing a 404-fold return on their initial investment. (thetimes.co.uk)

- Monzo: This digital bank has also provided substantial returns for its early backers. Employees and early investors have benefited from significant appreciation in share value, with opportunities to realize profits through secondary share sales. Monzo’s valuation reached £4.5 billion in 2024, reflecting its strong market position and growth trajectory. (techfundingnews.com)

- Starling Bank: While specific figures regarding investor returns are less publicized, Starling has demonstrated consistent profitability and growth. In 2023, the bank reported a pre-tax profit of £195 million, with total revenue reaching £453 million. This financial stability suggests positive outcomes for its investors. (thefinanser.com)

Balancing the Rewards with the Risks

While investing in fintech banking service companies offers high-reward potential, investors must also navigate risks, particularly when investing in equity.

- Regulatory Challenges: Changes in financial regulations can impact fintech firms’ operational models, especially those expanding internationally.

- Market Volatility: Fintech stocks, particularly early-stage startups, can experience sharp valuation swings based on market sentiment and economic conditions.

- Competitive Pressure: With new players entering the market, companies must constantly innovate to maintain a competitive edge.

- Liquidity Risk: Private equity investments in fintech firms often require longer holding periods, with limited short-term exit options.

The Future of Fintech Banking Services is Just Beginning

Fintech banking services have already disrupted traditional finance, but the real opportunity lies ahead as new technologies, AI-driven automation, and embedded finance redefine how people manage money. For investors willing to embrace innovation, strategic risk management, and long-term vision, fintech banking services remain one of the most compelling investment opportunities of the decade.

The question is—are you ready to be part of the next financial revolution?

Kudo, nga kudo!

IBAS është institucioni financiar me zgjidhjet më atraktive dhe më konkurruese për pagesat digjitale. Një prej mundësive të fundit që IBAS ka sjellur, është dergesa e parave deri në derë të shtëpisë. Koha kur pranuesi parave duhej ta vizitojë një kioskë të vogël, ku, jo rrallëherë, në mesin e shërbimeve financiare ofrohet servisim i celularëve, parfema të kopjuar e deri në produkte tekstili, me IBAS, i përket të kaluarës. Si institucioni i vetëm që ofron një shërbim të tillë, IBAS ka tejkaluar normën referente nga 200 pika, në 350,000+ lokacione. Po, po, IBAS u dërgon paratë, në çdo cep të Kosovës. Mjafton të keni një llogari pagesash në IBAS dhe të posedoni fonde për t’i tërhequr në derë të shtëpisë — për të tjerat kujdeset IBAS, me partnerët e autorizuar. Llogaria në IBAS mund të hapet nga distanca, duke shkarkuar aplikacionin nga https://ibas.world/join-ibas/

Në llogarinë tuaj në IBAS mund të pranoni para nga kudo në Botë dhe IBAS ua sjellë, kudo në Kosovë.

Pranimi i parave nga Zona Ekonomike Evropiane – IBAS është institucioni i vetëm, i themeluar jashtë Bashkimit Evropian, por që ka qasje në SEPA (Zona e Vetme e Pagesave në Evropë). IBAS u ofron klientëve të vet IBAN (llogari bankare) britanez me qasje në SEPA, pa pagesë të hapjes dhe pa pagesë të mirëmbajtjes.

Pranimi i parave nga Visa ose Mastercard – IBAS është institucioni i vetëm që iu mundëson pranimin e parave përmes vegzës së pagesës (Payment link), për dërgues që dëshiron të kryej transferin përmes Visa ose Mastercard, nga kudo në botë.

Pranimi i parave nga PayPal (Europe), Stripe, AirBNB, Wise, Revolut, Payoneer, etj – IBAS është i vetmi institucion financiar që mundëson pranimin e pagesave PA TARIFË, për të gjithë përdoruesit individual që posedojnë llogari PLOT, PREMIUM dhe INTEGRA, nga të gjitha platformat e mësipërme. Për më tepër, për klientët që plotësojnë kushtet, IBAS ofron Kredi për pagesa, PA INTERES, deri në 3 muaj. Dhe, jo vetëm – Për klientët e llogarisë INTEGRA ofron edhe sigurim shëndetësor deri në 25,000 euro, PA PAGESË.

IBAS, shoku yt, që ta çelë çdo derë, me e pa kartelë!

Na kontaktoni përmes ueb faqes, adresës elektronike, telefonit fiks apo rrjeteve sociale për të mësuar më shumë rreth gjithçka që ofrojmë!

IBAS përmbyll edhe një vit tjetër të suksesshëm!

Gjatë vitit 2024, IBAS ka vazhduar të ofrojë shërbime financiare inovative që kanë transformuar mënyrën se si individët dhe bizneset menaxhojnë financat e tyre. Me një fokus të lartë në teknologjinë moderne dhe digjitalizimin e shërbimeve financiare, IBAS u ka mundësuar klientëve të tij të përfitojnë nga shërbime të shpejta, të sigurta dhe të personalizuara, duke i ndihmuar ata të përballojnë sfidat e menaxhimit të financave.

Një nga arritjet më të rëndësishme të IBAS gjatë vitit 2024, ka qenë zhvillimi dhe implementimi i shërbimeve të reja financiare të cilat kanë ofruar mundësi të reja investimi dhe menaxhimi të fondeve për klientët. Teknologjia e avancuar që përdor IBAS, e kombinuar me një shërbim të shpejtë dhe efikas, u ka mundësuar individëve dhe bizneseve të kenë qasje të lehtë dhe të sigurt në shërbime financiare të nivelit të lartë. Për më tepër, institucionet dhe partnerët financiarë që kanë bashkëpunuar me IBAS, kanë shfrytëzuar mundësitë për rritjen e efikasitetit dhe optimizimin e proceseve të tyre financiare.

Në përmbyllje të vitit 2024, IBAS, përveç tjerash, ofron shërbimin fantastik “Në derë të shtëpisë”.

Pra IBAS, mbetet një lider në ofrimin e shërbimeve financiare digjitale dhe inovative, duke u angazhuar për një të ardhme ku digjitalizimi dhe siguria janë në qendër të çdo transaksioni. Me një strategji të fortë për të ardhmen dhe me një ekip të dedikuar për zhvillimin e vazhdueshëm të shërbimeve financiare, IBAS është pozicionuar për të vazhduar rritjen dhe zhvillimin gjatë viteve të ardhshme, duke u konsoliduar si një nga liderët kryesor në industrinë financiare digjitale!

Pse festat e fundvitit marrin tjetër kuptim me IBAS?

Festat e fundvitit janë një periudhë e veçantë, e mbushur me gëzim, dhurata dhe momente të bukura me të dashurit. Megjithatë, për shumë njerëz, buxheti mund të jetë një pengesë për realizimin e dëshirave festive. Këtu vjen në ndihmë “Kredi për Partnerë” nga IBAS, që ofron mundësinë të shfrytëzoni financime të shpejta dhe fleksibile për blerjet gjatë këtyre ditëve të veçanta.

1. Lehtësia e financimit të blerjeve

IBAS mundëson financim të shpejtë dhe pa stres për blerje festive, duke ofruar mundësinë e pagesave me këste për dhurata, pajisje për shtëpinë dhe shpenzime të tjera, duke i bërë festat më të lehta dhe më të këndshme.

2. Festoni pa kufizime financiare

Kredia për partnerë nga IBAS ju lejon të planifikoni dhe të bëni blerje pa shqetësime për shpenzimet e menjëhershme, duke krijuar mundësinë për të festuar pa frikën që keni tejkaluar buxhetin tuaj.

3. Mundësitë fleksibile dhe procesi i thjeshtë

IBAS ofron një proces të shpejtë dhe të thjeshtë për aplikim, me mundësi të thjeshta të pagesave, duke i mundësuar çdo individi të zgjedhë afatet dhe shumën që i përshtatet.

4. Realizoni festën tuaj ideale

Me mundësinë e kredive nga IBAS, kushdo mund të realizojë një festë të paharrueshme, pavarësisht situatës financiare, dhe të shijojë çdo moment të festave pa u ndjerë i kufizuar financiarisht.

Me kredi për partnerë nga IBAS, festat e fundvitit marrin një kuptim tjetër: mundësinë për të realizuar dëshirat dhe për të blerë dhurata pa shqetësime financiare, duke sjellë më shumë gëzim dhe mundësi për ju dhe ata që doni.

Refero dhe Fito me IBAS – Si të përfitosh shpërblime duke ndihmuar të tjerët

IBAS ofron një mundësi të jashtëzakonshme për të përfituar shpërblime për çdo referim. Programi është shumë i thjeshtë: ndihmo miqtë dhe familjarët të regjistrohen në IBAS dhe për çdo klient të ri që regjistrohet përmes teje, do të fitosh shpërblime. Sa më shumë njerëz të referosh, aq më shumë mund të fitosh, me shpërblime që variojnë nga shuma e kredisë.

Shpërblimet për Referime

Shpërblimet që merrni për çdo referim varen nga shuma e kredisë që klienti i referuar merr:

- 5€ për kredi nga 100€ deri në 500€

- 10€ për kredi nga 501€ deri në 1,000€

- 15€ për kredi nga 1,001€ deri në 1,500€

Për të marrë shpërblimet, mjafton të ndihmosh dikë të hapë një llogari në IBAS dhe të vendosë numrin tënd të telefonit si referues. Çdo herë që një klient i referuar nga ju merr kredi, do të merrni shpërblimin përkatës. Ky program është një mundësi e shkëlqyer për të ndihmuar ata që janë rreth teje të përfitojnë nga shërbimet e IBAS dhe për të përfituar vetë.

IBAS është një platformë fleksibile që të lejon të bësh blerje me këste dhe të menaxhosh financat më lehtë.

Shkarko aplikacionin IBAS sot, refero miqtë dhe familjarët, dhe fillo të përfitosh nga shpërblimet e programit “Refero dhe Fito”!

IBAS po ta çelë një derë magjike për festat e fundvitit.

Në këtë sezon festiv, IBAS sjell mundësinë e shkëlqyer për t’ju dhuruar një ndihmë financiare për realizimin e dëshirave tuaja këtë fundvit. Kampanja e fundvitit nga IBAS ka për qëllim të inkurajojë klientët ekzistues dhe ata potencialë të aplikojnë për kredi për të blerë dhurata tek partnerët, duke i ndihmuar ata të bëjnë festat më të veçanta. Me temën “Bëhu babadimër për festat e fundvitit”, kampanja përdor simbolin e drerit të Krishtlindjeve, që lidhet me forcën dhe e lidh atë me mundësitë që ofron kredia e IBAS për realizimin e dëshirave festive.

Me ndihmën e IBAS, ju mund të realizoni çdo dëshirë që keni për këtë fundvit, duke përfituar nga mundësitë financiare që ofrohen përmes kredive të lehta dhe efikase. Ky është momenti ideal për të festuar, për të dhuruar, dhe për të realizuar gjithçka që keni ëndërruar për këtë periudhë të vitit.

Festat janë koha kur të gjithë duam të bëjmë më të mirën për ata që duam. Pavarësisht nëse planifikoni të bëni një dhuratë speciale për dikë të dashur, apo të përmirësoni atmosferën festive të shtëpisë tuaj, shërbimet financiare të ofruara nga IBAS janë këtu për t’ju mbështetur dhe për t’ju ndihmuar të realizoni gjithçka.

Mos lejoni që buxheti të jetë pengesë për të realizuar festat e ëndrrave. Aplikoni për kredi në IBAS dhe shijoni një fundvit të mbushur me gëzim dhe dhurata me më të dashurit tuaj.

Aplikoni tani dhe bëni këtë sezonë festive të veçantë!

info@ibas.world

Pa Pare, Pa Kartelë – Me IBAS Çelë Çdo Derë!

A keni dëshiruar ndonjëherë të blini teknologji të re, të shfrytëzoni mundësi turistike apo të bleni pajisje elektroteknike, por keni pasur frikë nga shpenzimet e panevojshme administrative? Me kampanjën “Pa Pare, Pa Kartelë – Me IBAS Çelë Çdo Derë”, ky është momenti ideal për të blerë dhe bërë ato që gjithmonë keni ëndërruar! Merrni kredi deri në 1000 euro pa asnjë shpenzim administrativ shtesë dhe me aprovim brenda 5 minutash, nëse plotësoni kushtet.

Kjo mundësi është krijuar për ata që duan të bëjnë blerje të shpejta dhe pa shqetësime. Me këtë kampanjë, ju mund të merrni kredi dhe ta shpenzoni atë tek partnerët e IBAS, që ofrojnë produkte dhe shërbime të shkëlqyera në sektorët e teknologjisë, turizmit, elektroteknikës e shumë sektorë të tjerë. Pa kartela krediti dhe pa para cash, ju mund të bëni blerje dhe të përfitoni nga mundësitë e pagesave deri në 12 muaj, duke e bërë gjithçka më të lehtë dhe të përshtatshme për ju.

Ajo që e bën këtë ofertë edhe më tërheqëse është shpejtësia dhe lehtësia e procesit. Pasi të aplikoni për kredi, merrni aprovimin menjëherë dhe mund të filloni direkt ta shpenzoni shumën tek partnerët e IBAS. Në këtë mënyrë, mund të keni gjithçka që ju duhet – nga teknologjia më e avancuar, deri te shërbimet më të mira që do t’ju transformojnë jetën përmes lehtësimit financiar që IBAS ofron!

Mos e humbisni këtë mundësi! Merrni kredi deri në 1mijë dhe shpenzoni pa stres.

IBAS çelë çdo derë!

Kampanja 10/10/10/10: Mundësia për të fituar përjetë!

A dëshiron të kesh telefonin më të ri?

Kampanja 10/10/10/10 e IBAS është këtu dhe po sjell mundësinë e pabesueshme për të fituar nga një Iphone 16 Pro Max çdo muaj! Po, e lexuat mirë!

10 Iphone 16 Pro Max do të shpërndahen gjatë 10 muajve të ardhshëm nga IBAS, dhe ju mund të jeni një nga fituesit potencial!

Ja çfarë duhet të bëni për tu kualifikuar për lojën shpërblyese:

- Verifikoni llogarinë tuaj në IBAS dhe merrni 10 euro bonus.

Për të filluar, thjesht verifikoni llogarinë tuaj në IBAS dhe merrni 10 euro bonus menjëherë! E thjeshtë, e shpejtë dhe pa asnjë mundim! Me këto 10 euro, ju mund të filloni të bëni pagesa dhe të kualifikoheni për shpërblime fantastike. - Bëni 10 pagesa faturash dhe kualifikohuni për lojën shpërblyese.

Paguani 10 fatura përmes IBAS dhe bëhuni pjesë e lojës shpërblyese. Sa më shumë fatura që paguani, aq më shumë mundësi keni për të fituar! - Fitoni një nga 10 Iphone 16 Pro Max që IBAS do të dhuroj.

Çdo muaj, për 10 muaj rradhazi, një Iphone 16 Pro Max do të jetë në dorën e një fituesi fatlum! Kjo është mundësia juaj për të fituar telefonin më të fundit dhe më të kërkuar të momentit! - Kampanja Zgjat 10 Muaj.

Kampanja 10/10/10/10 do të jetë aktive për 10 muaj dhe çdo muaj një fitues potencial, i cili ka kryer të gjitha hapat e mësipërm, mund të marrë një Iphone 16 Pro Max. Çdo muaj është një mundësi e re për tu bërë fitues!

Mos e humbisni këtë mundësi të artë!

Ky është momenti për të bërë të gjitha hapat e mësipërm dhe për tu kualifikuar për shpërblimet fantastike. Verifikoni llogarinë tuaj, paguani faturat dhe bëhuni njëri nga fituesit potencial për një Iphone 16 Pro Max!

Kush është fituesi tjetër? Mund të jeni ju!

IBAS po ndihmon DYQANET të menaxhojnë fluksin e parave gjatë sezonit të festave!

Me afrimin e sezonit të festave, shitësit me pakicë në mbarë Kosovën po përgatiten për një rritje të kërkesës. Shitjet e Black Friday dhe të Krishtlindjeve pritet të sjellin një rritje të konsiderueshme të transaksioneve. Megjithatë, me rritjen e shitjeve vijnë kosto më të larta operacionale dhe menaxhimi i fluksit të parave gjatë kësaj periudhe të ngarkuar mund të jetë një sfidë.

IBAS është angazhuar të ndihmoj shitësit me pakicë të menaxhojnë fluksin e parave gjatë sezonit të festave.

Me afrimin e sezonit të festave, shitësit me pakicë në mbarë Kosovën po përgatiten për shitjet që i presin gjatë gjithë vitit.

Shitësit me pakice duke u bërë partner me IBAS, do të kenë mundësinë të krijojnë hapësira fantastike për klientët e tyre, duke ua mundësuar atyre që të shijojnë festat me blerjet që dëshirojnë, me çmimet më të mira dhe të mos brengosen për pagesa, sepse ato ua mundëson IBAS, sipas kritereve dhe kushteve qe ka karshi BQK.

Me Black Friday vetëm disa ditë larg, bizneset e e-commerce po inkurajohen të optimizojnë përvojën e klientit dhe të theksojnë veçanërisht masat e sigurisë së pagesave, ose rrezikojnë të humbasin mundësinë që dita paraqet për të rritur shitjet e tyre, për të tërhequr klientë të rinj dhe për të tërhequr shpenzimet.

Ndryshimi i zakoneve të blerjeve

Pavarësisht nga popullariteti i vazhdueshëm i metodave tradicionale të pagesave si kartat e debitit dhe kartat e kreditit për blerjet e festave, hulumtimet e reja nga platforma e pagesave nxjerrin në pah një zhvendosje të dukshme drejt metodave alternative të pagesës.

Potenciali në rritje i konsumatorëve, favorizojnë kuletat dixhitale kur bëjnë blerje në internet gjatë sezonës festive.

Ekspert të Bizneseve, shpjegojnë se për të tërhequr vëmendjen më të madhe të konsumatorit në Black Friday, shitësit me pakicë duhet të përqafojnë një gamë të gjerë mënyrash pagese: “Ka më shumë konkurrencë se kurrë midis shitësve për t’u siguruar që ata janë destinacioni përfundimtar i blerjeve. për konsumatorët”

“Tregtarët që ofrojnë mënyra të shumta pagese dhe një përvojë pagese pa probleme do të krijojnë diferencim, do të kujdesen për audienca të reja dhe do të rrisin normat e konvertimit.”

Bazuar në këtë IBAS ka vendosur të mbeshtesë DYQANET që ato të mund të përformojnë sa më mire gjatë këtyre FESTAVE.

Për të mos humbur këtë mundësi, të gjitha dyqanet të kontaktojnë në:

+383 38 600 300

+383 49 999 464

Thirrje për Investitorët potencial: Investoni në Bonot Qeveritare të Kosovës

Qeveria e Kosovës emeton bono qeveritare si një mundësi të sigurt dhe të leverdishme për investitorët që kërkojnë kthime të qëndrueshme në investimet e tyre. Bonot e emetuara me datë 5 shtator 2024 nga Qeveria kanë ofruar një normë mesatare të peshuar interesi prej 4.38% për një periudhë 10-vjeçare.

Kalendari i Emetimeve të Bonove Qeveritare, për vitin 2024 është si më poshtë:

1. Obligacion 5-vjeçar:

– Data e hapjes: 12 Nëntor 2024

– Data e mbylljes: 13 Nëntor 2024

2. Obligacion 2-vjeçar:

– Data e hapjes: 3 Dhjetor 2024

– Data e mbylljes: 4 Dhjetor 2024

3. Obligacion 5-vjeçar:

– Data e hapjes: 19 Dhjetor 2024

– Data e mbylljes: 20 Dhjetor 2024

Investimi në bonot e Qeverisë së Kosovës jo vetëm që ofron kthime të sigurta, por edhe ndihmon në mbështetjen e zhvillimit të vendit. Me afate të ndryshme investimi, këto bono janë të përshtatshme për çdo investitor që kërkon kthime të sigurta dhe afatgjata.

Si të investoni?

Për të përfituar nga këto mundësi, ju ftojmë të plotësoni formularin më poshtë me shumën që dëshironi të investoni. Ekipi ynë në IBAS, si këshilltar të licensuar të investimeve, do të përgatisë planin tuaj të personalizuar të investimit. Ne do të bëjmë studimin e nevojshëm, përgatitjen dhe mbikëqyrjen e zbatimit të këtij plani, duke siguruar që investimi juaj të jetë në përputhje me qëllimet tuaja financiare.

Mos humbisni mundësinë për të siguruar kthime të qëndrueshme dhe për të ndihmuar në zhvillimin e Kosovës!

Investimet në Instrumente Financiare: Përparësitë dhe Mangësitë e tyre

Në botën financiare, individët dhe bizneset shpesh kërkojnë mënyra të ndryshme për të rritur kapitalin e tyre. Një nga mënyrat më të zakonshme për të realizuar këtë qëllim është investimi në instrumente financiare. Por, për të marrë vendimin e duhur, është e rëndësishme të kuptohen përparësitë dhe mangësitë e secilit lloj investimi.

Në këtë publikim, do të shpalosim përparësitë dhe sfidat kryesore të investimeve në instrumentet financiare më të njohura, përfshirë bonot, aksionet, fondet e investimit dhe instrumentet alternative si “hedge funds” dhe “private equity”

1. Bonot (Obligacionet)

Bonot përfaqësojnë një instrument të borxhit, ku investitorët japin hua një korporate, institucioni ose një qeverie në këmbim të pagesave periodike të interesit dhe kthimit të kapitalit në fund të afatit të bonove.

Përparësitë:

- Rrezik i ulët: Sidomos për bonot qeveritare ose bonot e titulluara (të mbuluara me kolateral ose garanci institucionale) rreziku është minimal krahasuar me investimet e tjera, duke e bërë një zgjedhje të mirë për investitorët më konservatorë.

- Të ardhura të qëndrueshme: Bonot ofrojnë pagesa të rregullta të interesit që sjellin të ardhura të parashikueshme. Zakonisht ofrojnë interes më të lartë se institucionet bankare

- Diversifikim: Përfshirja e bonove në portofolin tuaj ndihmon në balancimin e rrezikut dhe në stabilizimin e kthimeve.

- Rishitje ose kolateralizim: Bonot zakonisht janë të tregtueshme në tregje sekondare apo edhe të ofrohen si kolateral për marrjen e ndonjë produkti kreditor nga institucione financiare.

Mangësitë:

- Rendiment i ulët: Krahasuar me investimet në aksione apo fonde alternative, bonot zakonisht ofrojnë kthime më të ulëta se instrumentet tjera, me rrezikshmëri më të lartë.

2. Aksionet

Aksionet përfaqësojnë një pjesë të kapitalit të një kompanie. Kur blini aksione, ju bëheni aksionar dhe përfitoni nga rritja e vlerës së kompanisë dhe shpërblimi i dividendëve.

Përparësitë:

- Potenciali për rritje të lartë: Aksionet ofrojnë mundësinë për kthime të larta, sidomos kur investoni në kompani që kanë rritje të qëndrueshme.

- Dividendët: Disa kompani ofrojnë dividendë, që mund të shtojnë të ardhurat tuaja nga investimet.

- Likuiditet: Tregjet e aksioneve zakonisht ofrojnë likuiditet të lartë, duke ju lejuar të blini dhe të shisni aksione shpejt.

Mangësitë:

- Rreziku i lartë: Vlera e aksioneve mund të ndryshojë ndjeshëm, dhe investitorët mund të humbin një pjesë ose të gjitha investimet e tyre në rast të falimentimit të kompanisë.

- Afati kohor: Aksionet mund të kërkojnë një horizont më të gjatë kohor për të realizuar kthime të larta, dhe tregjet mund të jenë të paqëndrueshme në periudha afatshkurtra.

3. Fondet e Investimit

Fondet e investimit përfaqësojnë një mënyrë për të investuar në një portofol të larmishëm të aksioneve, bonove dhe instrumenteve të tjera financiare, të menaxhuara nga profesionistë të fushës.

Përparësitë:

- Diversifikim automatik: Një fond ofron investim në shumë instrumente, duke zvogëluar rrezikun individual të secilit investim.

- Menaxhim profesional: Fondet e menaxhuara nga ekspertë ju japin mundësinë të përfitoni nga njohuritë e tyre për tregun.

- Shpenzime të ulëta: Disa fonde ofrojnë tarifa të menaxhimit më të ulëta në krahasim me investimet individuale.

Mangësitë:

- Tarifa të menaxhimit: Disa fonde mund të kenë tarifa të larta për menaxhimin e fondeve, gjë që mund të ndikojë në kthimin neto.

- Rendimenti i kufizuar: Ndërsa diversifikimi zvogëlon rrezikun, ai gjithashtu kufizon mundësinë për fitime të mëdha në investime individuale.

4. “Hedge Funds” dhe “Private Equity”

Këto instrumente alternative përfshijnë investime që zakonisht janë të disponueshme për investitorët institucionalë dhe individët me kapital të lartë. “Hedge funds” shpesh përdorin strategji komplekse për të gjeneruar kthime më të larta, ndërsa “private equity” fokusohet në investime në kompani private.

Përparësitë:

- Kthime potencialisht të larta: Strategjitë e “hedge funds” dhe “private equity” kanë potencial për kthime shumë të larta, sidomos për ata që janë të gatshëm të përballojnë rrezikun.

- Diversifikim i avancuar: Investitorët në “hedge funds” zakonisht kanë qasje në strategji dhe instrumente që nuk janë të disponueshme në tregjet tradicionale.

Mangësitë:

- Rrezik i lartë: Përdorimi i levave dhe strategjitë komplekse rrisin ndjeshëm rrezikun e humbjeve.

- Tarifa të larta: Tarifat e “hedge funds’ janë zakonisht të larta, me tarifa menaxhimi dhe shpërblimi për performancën që mund të zvogëlojnë fitimet.

- Mungesa e likuiditetit: Shumë fonde kanë periudha të gjata bllokimi, duke kufizuar aftësinë për të tërhequr kapitalin në mënyrë të menjëhershme.

IBAS, si institucion financiar i licencuar nga Banka Qendrore e Kosovës për Këshilltar për investime ofron një gamë të gjerë zgjidhjesh investimi që mund të përputhen me nevojat dhe qëllimet tuaja financiare. Për të bërë një zgjedhje të informuar, është e rëndësishme të keni një strategji të qartë dhe të vlerësoni tolerancën tuaj ndaj rrezikut, kohëzgjatjen e investimit dhe objektivat financiare.

Nëse jeni të interesuar të investoni, plotësoni formën më poshtë dhe personeli ynë i specializuar do të iu kontaktojë menjëherë për të diskutuar mundësitë e investimeve dhe profitin tuaj.

Si të fitojmë më shumë se në depozita bankare?

Të gjithë duam të fitojmë më shumë dhe fitimet tona t’i rrisim sa më shumë që mundemi. Në ditët e sotme, mundësi të tilla ka plot. Disa investojnë në patundshmëri, disa në depozita bankare, disa në bono thesari, e disa në tregje financiare, në tregje të rregulluara dhe të mbikëqyrura. Në këtë kontekst, më lejoni ta rikthej në vëmendjen tuaj që, krahas licencave të tjera, IBAS është i licencuar nga Banka Qendrore e Kosovës si Këshilltar i Investimeve për blerjen dhe shitjen e instrumenteve financiare, si aksionet, obligacionet, deftesat tregtare, etj.

Për të eliminuar maksimalisht rreziqet nga investimet në obligacione, investitorët zgjedhin të investojnë në tregje të rregulluara dhe të mbikëqyrura, ndërsa si instrument financiar parapëlqejnë investimin në obligacione ose bono të emetuara përmes institucioneve të licencuara për emetimin e instrumenteve financiare.

Këto institucione emetojnë bonde vetëm nëse korporata që ofron mundësitë e financimit gëzon shëndetin e duhur financiar dhe plotëson kriteret e përcaktuara në vendin ku synon të bëjë emetimin e bonove ose obligacioneve. Për të rritur sigurinë e investitorëve, emetuesit e bonove shpesh ofrojnë edhe kolateral. Bonot e kolateralizuara njihen edhe si Bono të titulluara, bono të siguruara, ose në anglisht, Securitized Bonds.

Për të emetuar Bono të titulluara, emetuesit ofrojnë kolateral që përbëhet prej aseteve ose prej pasurive të paluajtshme. Shpeshherë, bonot e titulluara marrin këtë titull edhe kir ato sigurohen nga institucione të licencuara dhe njihen si Këmbim i mospagesës së kredisë ose në anglisht Credit Default Swaps. Disa nga institucionet që ofrojnë sigurime të tilla janë disa nga bankat investive, si Barclays, HSBC, Standard Chartered, etj., dhe kompani të sigurimeve financiare, si AIG (American International Group), Monoline Insurers, etj.

Nëse ju dëshironi të investoni në mundësi të tilla, IBAS ka personel të specializuar, vendor e ndërkombëtar që kanë ekspertizën dhe dëshirën e jashtëzakonshme për të përgatitur dhe mbikëqyrur planin tuaj të investimit. Ndër të tjera, IBAS ju këshillon të investoni në tregje financiare të rregulluara dhe mbikëqyrura, siç janë emetimet e bonovo në Shtetet e Bashkuara të Amerikës, Mbretërinë e Bashkuar ose në Evropën Perëndimore.

Nëse dëshironi të filloni një rrugëtim si ky, ju lusim ta plotësoni formën në vazhdim dhe personeli ynë do t’iu kontaktojë menjëherë.

IBAS të jep STANDARD!

Pako STANDARD në IBAS ofron vlerë të pakrahasueshme shërbimesh, krejtësisht falas, dhe është ideale për ata që i vlerësojnë proceset e thjeshta të bankingut. E dizajnuar për ata që preferojnë thjeshtësinë, Pako STANDARD është perfekte nëse nuk e përdorni shpesh mundësinë “Blej Tani dhe Paguaj Më Vonë”, ose nëse nuk bëni transaksione të shpeshta. Kjo pako siguron menaxhim të lehtë financiar duke ofruar të gjitha elementet thelbësore pa kompleksitet të tepruar.

Shijoni transaksione të pandërprera me IBAN Britanik dhe akses në SEPA, që ju lejon të dërgoni dhe të merrni para me mbi 5,000 banka në të gjithë botën. Përmes pakos STANDARD mund të bëni lehtësisht mbushjen e kuletës tuaj virtuale të IBAS nga banka lokale ose ndërkombëtare, ose përmes Visa dhe Mastercard. Pako STANDARD gjithashtu mbulon pagesat për institucione publike, shërbime publike dhe ofron mundësi fleksibile për tërheqjen e parave dhe aplikimin për kredi ose mbitërheqje.

E fokusuar në nevojat tuaja thelbësore financiare, Pako STANDARD e IBAS bën që bankimi të jetë i thjeshtë dhe efikas. Përjetoni një përvojë financiare pa shqetësime që përputhet përsosmërisht me preferencat dhe stilin tuaj të jetës.

Eh po, edhe rrogën mund ta merrni kur të doni, pa e pritur të parin!

IBAS, shoku yt!

Remitencat përmes IBAS, për veç 3 euro, pavarësisht shumës

Diaspora kosovare në Gjermani ka gjithmonë një lidhje të fortë me vendlindjen, dhe dërgimi i remitencave është një nga mënyrat kryesore për të mbështetur familjet dhe të afërmit në Kosovë. Mirëpo, procesi tradicional i dërgimit të parave shpesh kërkon kohë për të vizituar ndonjë nga zyrat tradicionale për dërgimin e parave në Kosovë, paraqet kosto të larta dhe është i vështirë për t’u menaxhuar në kohën e duhur.

IBAS, si institucion financiar i licencuar nga Banka Qendrore e Kosovës, tash e një kohë ka sjell një zgjidhje inovative për të lehtësuar këtë proces dhe për t’ju ofruar mundësinë të dërgoni para në çdo kohë, kudo që të ndodheni në Gjermani, pa u lodhur nga procedurat tradicionale.

Si funksionon?

Përdorimi i IBAS është jashtëzakonisht i thjeshtë. Si një anëtar i SEPA-s (Zona e Pagesave të Vetme në Euro), IBAS ju ofron mundësinë të transferoni para direkt nga llogaria juaj bankare në Gjermani në llogarinë e përfituesit në Kosovë, pa pasur nevojë të shkoni në zyra tradicionale. Kjo jo vetëm që është e përshtatshme, por për ju, si dërgues, kjo shërbim zakonisht është falas dhe paratë arrijnë në Kosovë, brenda pak sekondave, përveç ndonjë rasti kur banka juaj mund të mos jetë pjesë e SEPA inatant. Në këto raste, paratë që ju i dërgoni arrijnë në Kosovë brenda një dite pune.

Përfituesi në Kosovë

Për të marrë paratë, përfituesi duhet të ketë një llogari pagesash në IBAS, e cila është plotësisht pa pagesë për hapje dhe mirëmbajtje. Me hapjen e llogarisë në IBAS, përfituesi automatikisht merr një llogari bankare britaneze, e cila i mundëson qasjen në rrjetin SEPA. Kështu, ai paguan vetëm 3 euro, pa marrë parasysh shumën që merr nga ju. Ky proces është i thjeshtë, transparent dhe pa kosto të fshehura. Nëse pranuesi ka nevojë për ndihmë, atëherë personeli i IBAS do t’iu ndihmojë, pa pagesë.

Përfitimet për Diasporën

– Pa shpenzime për dërguesin: Si një anëtar i SEPA-s, IBAS mundëson transferimin e parave nga Gjermania në Kosovë, zakonisht pa kosto për ju si dërgues, përveç nëse politika e bankës suaj është ndryshe nga bankat tjera të Gjermanisë.

– Dërgim nga komoditeti i shtëpisë: Nuk keni më nevojë të shkoni në zyra apo agjenci; gjithçka mund ta bëni online nga llogaria juaj bankare.

– Shpejtësi dhe siguri: Transferet bëhen në mënyrë të shpejtë dhe të sigurt, duke ofruar shërbime pa vonesa e pa ngatërresa.

Përfitimet për përfituesin në Kosovë

– Llogari pa pagesë: Hapja dhe mirëmbajtja e llogarisë në IBAS janë plotësisht pa pagesë.

– Kosto të ulëta: Përfituesi paguan vetëm 3 euro për çdo transfertë, pavarësisht shumës.

– Qasje në SEPA: Përmes llogarisë së tyre IBAS, përfituesi ka qasje në rrjetin SEPA, duke i lejuar atij të marrë remitenca shpejt dhe me kosto të ulëta.

– Mund të marrë edhe kredi për pagesa apo të merr ndonjë nga pakot PLOT, INTEGRA ose PREMIUM që ju mundësojnë të kryejnë bëjnë blerje e të paguajnë më vonë (Buy Now Pay Later) pa paguar interes, për tre (3) muaj, e shumë mundësi tjera.

Me IBAS, ju mund të kujdeseni për të dashurit tuaj në Kosovë në mënyrën më të lehtë, më të lirë dhe më të sigurt. Bashkë, ne lehtësojmë mbështetjen që diaspora kosovare ofron për vendlindjen.

IBAN të Kosovës për individë, biznese dhe OJQ

Falë avancimit të legjislacionit nga Banka Qendrore e Kosovës, IBAS ka filluar dhënien e numrit ndërkombëtar të llogarisë bankare (IBAN) për individët, bizneset dhe OJQ. Të gjithë IBAN që lëshohen nga IBAS janë pa pagesë të mirëmbajtjes dhe ofrojnë pranimin ose dërgimin e parave në cilëndo llogari bankare brenda apo jashtë vendit. Krahas llogarisë bankare të Kosovës, IBAS vazhdon të lëshojë edhe numër të llogarisë bankare britaneze, përmes së cilës të gjthë poseduesit mund të kenë qasje në SEPA (Single European Payment Area) që mundëson pranimin ose dërgimin e parave nga ose për në Evropë brenda sekondave dhe një tarifë prej vetëm tre (3) euro, për çfarëdo shume. Për më tepër, IBAS vazhdon të ofrojë kredi ose mbitërheqje për pagesa me afat kthimi deri në 12 muaj dhe modelin “Bli Tani e Paguaj më Vonë” ose BNPL, me interes 0% për tre (3) muaj.

Këto janë vetëm disa nga zhvillimet dhe mundësitë që IBAS ka ofruar për klientët e vetë. Me të njëjtën dinamikë do të vazhdojë edhe me zhvillime të reja dhe zgjidhje atraktive për klientë. Kushdo që vonohet të jetë klient i yni do ta humbas një përvojë të veçantë. E për ty që ke vendosë, kjo është vegza e portës https://ibas.world/join-ibas/ se ndoshta IBAS ka vendosë ta bëjë një surprizë për ty 😊.

Pass-through eWallet është trashëgimia e radhës nga IBAS

Shpesh kemi përjetuar situata të bezdisshme kur duhet të kryejmë një pagesë në një institucion publik ose privat dhe gjendemi në një situatë ku, ose nuk kemi mundësi pagese elektronike, ose nuk kemi para të gatshme, ose nuk i kemi informatat e nevojshme për të kryer pagesën përmes bankimit elektronik (eBanking) ose bankimit mobil (mBanking). Për të eliminuar situata të tilla, IBAS ka sjellë teknologjinë e fundit: Pass-through eWallet. Nuk ka një të dytë, as në Kosovë e as në Ballkanin Perëndimor.

Çfarë është në të vërtetë Pass-through eWallet?

Viteve të fundit kemi dëgjuar shumë për eWallet ose kuletat elektronike. Një kuletë elektronike ofrohet nga institucione financiare, të licencuara nga rregullatorët e vendeve të operimit dhe ofrojnë shërbimin e emetimit dhe/ose mbajtjes së parave elektronike në një llogari pagese, prej së cilës, më pastaj me inicimin dhe konfirmimin e mbajtësit të saj kryhen pagesa për palë të treta, të sektorit publik ose privat, apo edhe transferimit tek një person privat. Parakusht për realizimin e pagesave të tilla është emetimi paraprak i parasë elektronike në një pikë fizike të institucionit financiar, dërgimi i parave nga një llogari bankare, ose mbushja e kuletës elektronike përmes kartelave të Visa ose Mastercard. Pra, një transaksion ose pagesë kryhej në dy cikle të ndryshme – 1) emetimi i parave në kuletën elektronike ose mbushja paraprake e kuletës elektronike dhe 2) inicimi dhe konfirmimi i pagesës për përfituesin e përzgjedhur. Por, me lansimin e inovacionit Pass-through eWallet nga IBAS, mënyra paraprake mbetet primitive. Kjo, sepse tashmë teknologjia e IBAS ju mundëson të kryeni pagesa elektronike edhe pa emetuar ose mbushur kuletën tuaj elektronike me para. Me Pass-through eWallet të IBAS ju mund të kryeni pagesë ose transfere direkt nga kartela juaj e Visa ose Mastercard. Për më tepër, falë mundësive ligjore që ofron Ligji 03/L-196, nuk keni nevojë të krijoni identitetin digjital. Por, kjo nuk është mundësia e vetme. Përmes teknologjisë së IBAS ju mund të kryeni pagesë edhe nëse nuk keni para në kartelën tuaj të Visa ose Mastercard. Këtë ua mundësojnë një nga tre llogaritë e “Blej Tani e Paguaj më Vonë” që i ofron IBAS.

Eksploroni fuqinë e Pass-through eWallet dhe shijoni lirinë e të qenit në kontroll të financave tuaja, pa stresin e mungesës së fondeve kur ju nevojiten më së shumti. Vizitoni faqen tonë të internetit https://ibas.world/join-ibas/ dhe krijoni llogarinë për të kryer pagesa në cilindo institucion publik, kurdo që keni nevojë.

Ekskluzive në IBAS: Merr 500 Euro pa interes brenda sekondit!

A keni dëgjuar për mundësinë më të fundit që ofron IBAS për klientët e saj? Nëse historia juaj kreditore është e kategorisë A në Regjistrin Kreditor të Kosovës, jeni vetëm një klikim larg për të marrë 500 euro pa interes për tre muaj! Ky është avantazhi ynë i ri i produktit Bli Tani, Paguaj Më Vonë (BNPL).

Përfitoni menjëherë – Fondet në llogarinë tuaj brenda sekondit!

Me BNPL nga IBAS, ju nuk duhet të prisni për të pasur qasje në fonde. Sapo të nisni procesin e realizimit të pagesës dhe nuk keni fonde në llogarinë e IBAS, juve do të ju shfaqet mundësia të zgjidhni një nga pakot e IBAS që ofrojnë deri në 500 euro kredi për realizimin e pagesave me interes 0% për tre muaj. Kjo do t’ju mundësojë të shfrytëzoni ato ofertat e momentit apo të mbuloni shpenzimet urgjente pa asnjë vonesë.

Si funksionon kjo magji financiare?

- Vetëm me Një Klikim: Aktivizoni ofertën e BNPL direkt nga aplikacioni ynë.

- Qasje e Menjëhershme: Fondet disbursohen në llogarinë tuaj në IBAS, më shpejt se ç’rrjedh sekonda.

- Zero Interes: Shfrytëzoni 500 euro për deri në tre muaj pa paguar asnjë interes.

E thjeshtë, e shpejtë, e sigurt – IBAS vazhdon të përmirësojë mënyrën se si ju menaxhoni financat tuaja, duke ju dhënë mjetet për të bërë zgjedhje të mençura me fleksibilitet të plotë. Çdo transaksion është i mbrojtur me teknologjinë më të fundit të sigurisë, duke ju siguruar rehati të plotë ndërsa përdorni këto fonde sipas nevojës.

Mos e humbni këtë mundësi të artë! Bëni klik për të aktivizuar ofertën tuaj të BNPL tani dhe filloni të shijoni lirinë e të blerëve edhe kur nuk keni para. Krijoni dhe verifikoni llogari në IBAS, ose hapni aplikacionin e IBAS për të marrë 500 euro, pa interes për tre muaj, brenda një sekondi dhe vetëm me një klik.

Kliko këtu për të hapur tani llogarinë tek IBAS – shoku yt.

Prezencë globale dhe Payment Gateway për Visa dhe Mastercard – Shërbimi më i ri nga IBAS

Prezencë globale dhe Payment Gateway për Visa dhe Mastercard – Shërbimi më i ri nga IBAS

Në tregun e Kosovës ka ekzistuar një hapësirë ku bizneset nuk kanë arritur të ofrojnë pagesa digjitale përmes Visa dhe Mastercard si rezultat i kërkesave, vonesave dhe burokracive. IBAS synon ta eliminojë pikërisht këtë rrethanë. Për këtë qëllim, ka zhvilluar platformën për dyqane virtuale në teknologji web, si dhe ka zhvilluar plug-ins që mundësojnë ndërlidhjen me Shopify dhe WooCommerce. Një zhvillim i tillë, përveç që ju mundëson të keni një dyqan virtual në Kosovë, ju mundëson ta keni një të tillë edhe në nivel global. Pra, me ndihmën e IBAS, ju lehtësisht mund të filloni shitjen në tregjet amerikane, evropiane, e kudo tjetër.

Një ambient të ngurtë dhe burokratik IBAS e shndërron në mundësi të jashtëzakonshme biznesi. Prej një tregu të limituar në 1.5 milionë banorë, IBAS ju jep mundësinë të bëheni pjesë e një tregu prej mbi 800 milionë banorë e mbi 50 milionë biznese.

Dhe jo vetëm kaq, IBAS ju ndihmon edhe të hapni dyqanin virtual ose ta zhvilloni atë, edhe të ju kreditojë për pagesat ndaj furnitorëve tuaj, dhe ta organizoni transportin e shitjeve tuaja deri në adresën e blerësit tuaj. Qoftë nevoja, IBAS ju ndihmon edhe me marketing digjital që produktet dhe shërbimet tuaja t’i adresoni tek

klientët specifik, në cilindo shtet të botës.

Çka po pret e s’po bëhesh mbret?! 😊 Nëse je gati, atëherë na kontaktoni duke plotësuar të dhënat në këtë formular.

IBAS dhe rTrust në Qendër të Vëmendjes në AmCham Expo Space!

IBAS, në bashkëpunim të ngushtë me rTrust, u shfaq si partner i dalluar në ngjarjen AmCham Expo Space, organizuar në bashkëpunim me FLORIGallery dhe Prishtina Mall gjatë muajit që shënon përvjetorin e pavarësisë së Shteteve të Bashkuara të Amerikës.

IBAS prezantoi inovacionin e fundit – shërbimin e kredive me nënshkrim elektronik, i mundësuar nga platforma rTrust. Ky shërbim lejon qytetarët e Kosovës të marrin kredi deri në 5,000 euro pa nevojën për të vizituar zyrat e IBAS fizikisht. Të gjitha procedurat zbatohen online, përmes nënshkrimit elektronik, duke paraqitur një hap të madh drejt transformimit digjital të shërbimeve financiare.

Gjatë ngjarjes, ambasadori amerikan, z.Hovenier, nënvizoi marrëdheniet e forta ekonomike mes kompanive kosovare dhe Shteteve të Bashkuara, duke theksuar rëndësinë e tyre në panair.

Profesionistë dhe figura kyçe nga sektorë të ndryshëm shprehën interes të madh për shërbimet e avancuara të ofruara nga IBAS.

Pjesëmarrësit patën rastin të njihen më nga afër me shërbimin e kredive me nënshkrim elektronik dhe të eksplorojnë mënyrat se si IBAS mund të ndihmojë në lehtësimin dhe përmirësimin e menaxhimit të financave personale. Në këtë mënyrë, IBAS vazhdon të ndjekë misionin e vet për të ofruar zgjidhje inovative dhe efikase që u përgjigjen nevojave të tregut të Kosovës dhe më gjerë.

AmCham Expo Space u shënua si një sukses i madh, duke theksuar rëndësinë e partneriteteve dhe inovacioneve për përparimin e sektorit të financave dhe shërbimeve bankare.

IBAS, me përkushtimin e tij ndaj përmirësimit të përvojës së klientit dhe integrimit të teknologjive të reja, konfirmon pozitën e tij si lider i inovacioneve dhe industrinë financiare në Kosovë, e përtej.

Lansimi Kredive të Reja deri në 5,000 Euro vetëm me Nënshkrim Elektronik – Një trashëgimi e radhës nga IBAS

IBAS, lider në inovacionin e shërbimeve financiare, ka kënaqësinë të ju njoftojë për një trashëgimi të jashtëzakonshme në tregun e Kosovës dhe të Ballkanit Perëndimor.

Tashmë, mundësia për të marrë kredi për pagesa, deri në 5,000 euro, është bërë akoma më e thjeshtë dhe e arritshme falë nënshkrimit elektronik. Me këtë risi, klientët e IBAS nuk kanë nevojë të vizitojnë asnjë prej lokacioneve të IBAS, por mund të përfundojnë të gjithë procesin në distancë, nga kudo që ndodhen.

Ky hap i guximshëm shënon herën e parë që një opsion i tillë ofrohet në këto rajone, duke rikonfirmuar pozitën e IBAS si pionier në fushën e inovacioneve bankare dhe zgjidhjeve atraktive (Innovative Banking and Attractive Solutions).

Ky inovacion është mundësuar nga rTrust, si ofrues i besuar i shërbimeve eIDAS, i njohur në gjithë zonën ekonomike të Bashkimit Evropian dhe Qeveria e Kosovës, dhe shënon një nga arritjet kryesore të IBAS në industrinë financiare të rajonit.

Procesi për të marrë këtë lloj kredie është i thjeshtë dhe përfshin këto hapa:

1. Shkarkimi i aplikacionit të IBAS nga App Store ose Play Store dhe krijimi i llogarisë.

2. Aplikimi për kredi ose mbitërheqje për pagesa.

3. Nënshkrimi elektronik i kontratës së kredisë, i mundësuar nga teknologjia më e fundit e nënshkrimeve dixhitale të rTrust.

Ky inovacion është sjellë për juve, andaj mos hezitoni të përfitoni nga kjo mundësi që ofron më shumë fleksibilitet dhe efikasitet.

Vizitoni faqen tonë të internetit https://ibas.world/join-ibas/ dhe përjetoni lirinë e veprimit që u sjellë inovacioni ynë.

IBAS — The most innovative FinTech in Western Balkans stages 59% Growth

We’re thrilled to share some incredible news with our valued customers and partners! 2023 was a phenomenal year for IBAS, marked by a staggering 59% business growth compared to 2022. This exceptional achievement solidifies our position as the most successful fintech institution the Western Balkans.

A Vision Realized

IBAS was born in 2019, fueled by a passionate team with a revolutionary vision: to transform the global financial landscape, starting from our home in Kosovo. Our unwavering dedication led us to secure a license from the Central Bank of Kosovo, establishing us as a premier electronic money issuer and credit provider for payments. We further expanded our license to encompass Investment Advisory services, empowering clients to buy and sell shares, bonds, and convertible bonds.

A brighter financial future

At IBAS, we’re committed to building a brighter financial future — one that prioritizes accessibility, convenience, and efficiency. Our comprehensive financial solutions cater to your every need, encompassing:

- Digital Payments and ePOS: Seamless transactions with British IBAN, SEPA access, ePOS and OR code solutions, debit cards, secure payment gateways, utility bill payments, and hassle—free payments for public institutions.

- International Money Transfers: Effortless transfers to and from over 5,000 European Economic Area banks, convenient transfers from Stripe and Wise, and swift payments for outsourcing platforms like Upwork, Fiverr, PeopleperHour, and TopTal.

- Loans for Payments: We offer a variety of loan options to suit your needs, including loans for payments up to £100,000, overdraft facilities up to £100,000, and a Buy Now Pay Later scheme with three months interest-free.

- Investment Advisory Services: Our expert advisors provide personalized investment plans and guidance, empowering you to make informed decisions about buying and selling financial instruments such as shares, bonds, and commercial receipts.

Thank You!

This remarkable growth wouldn’t be possible without the trust and support of our incredible customers and partners. We’re deeply grateful for your continued partnership and look forward to achieving even greater heights together in 2024 and beyond!

Stay tuned for more exciting announcements as we continue to innovate the future of finance!

Pse kompania juaj duhet të emetojë obligacione?

Në tregun konkurrues të sotëm, kompanitë janë vazhdimisht në kërkim të mënyrave për t’u rritur. Një mundësi e rritjes së kapitalit është përmes emetimit të obligacioneve. Sidoqoftë, deri më sot, kjo formë e financimit, në Kosovë nuk i është mundësuar biznesit privat. Kjo në mungesë të legjislacionit për tregjet e kapitalit. Por, kjo nuk i ndalon bizneset që emetimin e obligacioneve ta bëjnë në Evropë, përkatësisht në Angli, aty ku tregjet e kapitalit janë të rregulluara dhe mbikëqyrura. IBAS, si institucion i licencuar nga Banka Qendrore e Kosovës për Këshilltar të Investimeve mund të ju ndihmojë në këtë drejtim.

Disa nga përfitimet e emetimit të obligacioneve:

- Qasja në fonde: Emetimi i obligacioneve u siguron kompanive një fluks të menjëhershëm të qarkullimit, pa shitur aksione ose pa humbur kontrollin mbi kompaninë. Kjo mënyrë e financimit mund të përdoret për një sërë qëllimesh, duke përfshirë financimin e projekteve të reja, të rris mundësinë e blerjes së mallrave/shërbimeve për qarkullim, shtimin/zgjerimin e objekteve a aseteve, ose ri financimin e borxhit ekzistues.

- Pagesat e interesit fiks: Ndryshe nga kreditë bankare ose instrumentet tjera kredituese bankare, obligacionet zakonisht vijnë me pagesa fikse të interesit. Kjo parashikueshmëri i lejon kompanitë të menaxhojnë më mirë fluksin e parasë dhe buxhetimin e tyre, pavarësisht nga luhatjet në normat e interesit.

- Baza e larmishme e investitorëve: Obligacionet tërheqin një gamë të gjerë investitorësh, duke përfshirë investitorët institucionalë, fondet e pensioneve dhe investitorët individualë që kërkojnë kthime të qëndrueshme. Duke shfrytëzuar këtë bazë të larmishme investitorësh, kompanitë potencialisht mund të sigurojnë kushte më të favorshme për financimin e tyre.

- Fleksibiliteti afatgjatë: Obligacionet mund të emetohen me një shumëllojshmëri maturimesh, duke filluar nga obligacionet afatshkurtra (më pak se një vit) deri tek obligacionet afatgjata (deri në 30 vjet ose më shumë). Ky fleksibilitet u lejon kompanive të përshtasin financimin e tyre sipas nevojave të projekteve ose iniciativave specifike.

- Profili i përmirësuar i kredisë: Emetimi me sukses i obligacioneve mund të përmirësojë profilin e kreditit të një kompanie dhe të përmirësojë gjendjen e përgjithshme financiare. Kjo mund të rezultojë në kosto më të ulëta të huamarrjes në të ardhmen dhe rritje të qasjes në burime të ndryshme të kapitalit.

Obligacione pa kolateral

Obligacionet e pasiguruara (pa kolateral), të njohura gjithashtu si obligacione, nuk janë të lidhura me ndonjë aktiv specifik, ndryshe nga obligacionet e siguruara, të cilat mbështeten nga aktive ose kolateral specifik. Në vend të kësaj, investitorët mbështeten vetëm në aftësinë kreditore dhe reputacionin e kompanisë emetuese.

Disa nga përparësitë e obligacioneve të pasiguruara:

Kërkesat më të ulëta të kolateralit: Emetimi i obligacioneve të pasiguruara eliminon nevojën që kompanitë të lënë peng asete specifike si kolateral. Kjo mund të jetë veçanërisht e dobishme për kompanitë me asete të kufizuara ose ato që kërkojnë të ruajnë fleksibilitetin e tyre për kreditimet e ardhshme.

- Kërkesat më të ulëta të kolateralit: Emetimi i obligacioneve të pasiguruara eliminon nevojën që kompanitë të lënë peng asete specifike si kolateral. Kjo mund të jetë veçanërisht e dobishme për kompanitë me asete të kufizuara ose ato që kërkojnë të ruajnë fleksibilitetin e tyre për kreditimet e ardhshme.

- Lehtësi më e madhe për investitorë: Obligacionet e pasiguruara janë më të lehta për investitorët, sepse ata nuk kanë nevojë të merren me vlerësim kolaterali ose me vënien peng gë tij. Kjo sigurisht që ndikon në çmimin e obligacioneve. Megjithatë, emetimi i këtij llojit të obligacioneve është i lidhur ngusht me aftësinë paguese të kompanisë që i emeton ato.

- Fleksibiliteti në menaxhimin e aseteve: Duke zgjedhur obligacione të pasiguruara, kompanitë ruajnë fleksibilitet më të madh në menaxhimin e aseteve dhe operacioneve të tyre. Financimi i tyre nuk varet me disponueshmërinë e kolateralit dhe aftësinë e lënies peng.

- Ndërtimi i besimit dhe i reputacionit: Emetimi i suksesshëm i obligacioneve të pasiguruara tregon besim në fuqinë financiare të kompanisë. Kjo mund të rrisë besimin e investitorëve në menaxhimin e kompanisë, duke çuar në marrëdhënie më të forta afatgjata dhe qasje të vazhdueshme në tregjet e kapitalit.

Si përfundim, emetimi i obligacioneve, veçanërisht i obligacioneve të pasiguruara, paraqet një mundësi të jashtëzakonshme për kompanitë që të rrisin kapitalin, të diversifikojnë bazën e tyre të investitorëve dhe të forcojnë pozicionin e tyre financiar. Duke marrë parasysh me kujdes përfitimet dhe propozimin e vlerës së emetimit të obligacioneve, kompanitë mund të hapin rrugë të reja për rritje dhe inovacion duke maksimizuar vlerën e aksionerëve.

Nëse ju vlerësoni se obligacionet mund ta rrisin fuqinë dhe konkurrueshmërinë e biznesit tuaj, na kontaktoni për të mësuar më shumë rreth këtyre mundësive.

Plotëso formularin për informacione të mëtejshme

Banks, Fintechs, and Businesses: Building Synergies for Accelerating Access to Finance in Kosovo

As the pioneering Fintech company in Kosovo, IBAS, represented by its founder and solution architect, Mr. Gazmend, made a significant impact at an event co-hosted by USAID and the Central Bank of Kosovo. The theme was “Banks, Fintechs, and Businesses: Building Synergies for Accelerating Access to Finance.”

In his presentation, Mr. Gazmend eloquently outlined the unique challenges and opportunities that come with being a forerunner in the fintech space. He delved into the critical role of a supportive ecosystem, which hinges on the collaboration of government entities, regulatory agencies, and financial infrastructures. Notably, he showcased IBAS’s innovative solutions, such as commission-free digital transactions, no-fee SEPA transfers, interest-free options for the ‘Buy Now Pay Later’ scheme, and the eagerly anticipated investment advisory services, all aligned with current regulations.

Mr. Gazmend concluded with a powerful call to action for regulatory bodies and other stakeholders. He urged them to adapt to the evolving landscape shaped by PSD2 regulations and the advent of open banking. Additionally, he advocated for partnerships with governmental organizations to ensure that businesses provide at least one alternative to cash payments.

The IBAS team expressed their heartfelt appreciation for the audience’s acknowledgement and enthusiastic reception of their groundbreaking contributions. They reiterated their dedication to perpetually innovate and enhance value in the fintech domain.

Paul Wild Appointed Chairman of the Board at IBAS

We are happy to announce a significant and strategic addition to the leadership team at IBAS. Mr. Paul Wild has been appointed as the Chairman of the Board, after his approval by the Central Bank of Kosovo. This appointment marks a pivotal moment for IBAS, as we welcome a leader with a wealth of experience and a proven track record in the financial sector.

Paul Wild is a highly accomplished banker and leader with a distinguished career which started at Barclays Bank UK and has spanned over 30 years. He possesses a unique blend of experience in SME, corporate banking, retail, and development bank consulting. What sets Paul apart is his strong record of implementing projects for international development institutions and his ability to drive cross-functional change management while creating businesses for sustainable growth.

Paul has worked extensively in various countries, including Albania, where he played a pivotal role in creating Raiffeisen Bank business lending unit, he later joined International Commercial Bank Albania as Head of Retail and small business banking.

International Expertise

Paul’s expertise extends beyond Albania. He has undertaken assignments and made a significant impact in multiple EU countries, including Slovakia, Hungary, Czech Republic and further afield, Turkey, Africa and South East Asia.

Notable achievements include:

Slovakia: Paul formed a Small and Medium-Sized Enterprise (SME) lending team at VUB (an subsidiary of Intesa Sanpaolo) and successfully onward lending a credit line provided by the European Bank for Reconstruction and Development.

Hungary: He advised Budapest bank lease company on how to position and communicate its Agriculture leasing products in the Hungarian market.

Turkey: Paul managed the processing and granting of Project Finance loans at Halk Bank under a European Investment Bank Credit Line.

Recently Paul has completed assignments for the EBRD for three of Africas top 10 banks in the areas of Small Business lending, sustainable finance and digital transformation. As well as regulatory assignments for GIZ with the Central Bank of Egypt and Export Promotion for USAID TRADE, Egypt.

Paul’s impact on these countries showcases his ability to bring International Best practice and Innovation to create positive change and drive growth in the banking sector.

A Leader in Sustainable Finance

Paul has an MSc in Sustainable Finance from the London Institute of Banking and Finance. His commitment to sustainability and innovative financial practices aligns perfectly with IBAS’s mission and values.

Chairman of the Board at IBAS

As Chairman of the Board at IBAS, Paul Wild’s deep expertise and transformative leadership will play a critical role in shaping our strategic direction and guiding our organization towards greater success. We are confident that Paul’s vast experience, international perspective, and successful track record will be instrumental in leading IBAS into a new era of growth and innovation.

Join us in welcoming Paul Wild as the Chairman of the Board at IBAS. We are excited about the opportunities and insights he will bring to our organization.

IBAS – A Remarkable Visit to the University of Pristina

In a significant outreach effort, PBC Group, alongside its innovative financial services platform IBAS, recently visited the University of Pristina to engage and educate the students about the remarkable world of financial services. This educational endeavor was a part of the ongoing commitment of PBC Group to share its expertise with the academic community.

Mr. Gazmed , the visionary founder of PBC Group, took the stage to kick off the lecture by providing an insightful overview of PBC Group and its diverse array of products. Among the gems of the PBC Group family, he emphasized IBAS, an innovative banking and attractive solution financial services platform, the British College of Science by PBC Academy, VERPO, rTrust, a marketing referral platform, and MARK, their newest marketing agency.

The students of the second-year Marketing Department at the University of Prishtina were in for a treat as the CEO of IBAS, Mr. Hajdari, took the stage to provide an in-depth exploration of the services offered by this groundbreaking platform.

The visit to the University of Pristina was more than just a lecture; it was a unique opportunity for students to gain valuable insights into the ever-evolving fields of financial services and marketing. As the world of business and commerce continues to evolve at an unprecedented pace, such interactions between industry experts and the academic community play a pivotal role in bridging the gap between theory and real-world application.

PBC Group’s visit to the University of Pristina not only enriched the students’ understanding of the financial landscapes but also inspired them to explore the endless possibilities and opportunities that await them in the industry. This remarkable initiative served as a reminder of the importance of knowledge sharing and collaboration between educational institutions and industry leaders.

We express our heartfelt gratitude to Professor Nail Reshidi and his dedicated staff for their warm welcome and support during our visit to the University of Pristina. Their hospitality and enthusiasm made our educational outreach a truly memorable experience. It is through the collaboration and partnership with esteemed educators like Professor Reshidi that we can bridge the gap between industry and academia, inspiring the next generation of professionals. We look forward to future interactions and endeavors that will continue to enrich the educational landscape and empower students with valuable knowledge and insights.

IBAS: Embracing Pink for Breast Cancer Awareness

October is Breast Cancer Awareness Month, a time when communities worldwide unite to promote awareness and support for those affected by breast cancer. At IBAS, we’re proud to join this global cause.

Why Breast Cancer Awareness Matters:

Breast Cancer Awareness Month is significant for several reasons:

Early Detection: Encouraging early screenings and awareness saves lives by detecting breast cancer at a treatable stage.

Support: It’s a time to stand with those battling breast cancer and offer them the support and care they need.

Research: Raising awareness also means raising funds for research, leading to better treatments and, ultimately, a cure.

Join US!

You can make a difference too:

Educate Yourself: Learn about breast cancer and early detection methods.

Support Fundraising: Donate to breast cancer charities and participate in related events.

Spread Awareness: Share information with your friends and family.

Offer Support: Be there for those facing breast cancer, offering your help and understanding.

Together, we can make Breast Cancer Awareness Month a time of hope, support, and progress. Join IBAS in making a positive impact in the fight against breast cancer.

Strengthening Economic Partnerships: Luxembourg Ambassador’s Visit Sparks Collaboration and Future Opportunities

We are deeply honoured by the visit of His Excellency, Mr. Dietz, the Ambassador of Luxembourg, accompanied by several prominent businesses from Luxembourg. This visit, along with the insightful discussions we engaged in, holds significant promise for fostering robust partnerships.

During his visit, we had the privilege to extend our gratitude to Mr. Dietz on behalf of our group of companies for Luxembourg’s unwavering support across various sectors, with a particular emphasis on Vocational Education and Training (VET). The success stories of initiatives such as IBAS in the financial sector, PBC in information technology, and the exemplary performance of PBC Academy in VET education serve as tangible demonstrations of our commitment to fostering meaningful collaboration and value exchange in the Luxembourg market.

Furthermore, we are pleased to announce that we have agreed on follow-up meetings with the express purpose of translating our discussions into tangible business opportunities and mutual benefits for both countries. This commitment underscores our shared dedication to building enduring economic bridges between our two nations.

IBAS – Inovacione të njëpasnjëshme, e gjitha që duhet të dini

IBAS po vazhdon me rritje të vazhdueshme, duke i ofruar përdoruesve qasje shumë të lehtë në financat e tyre.

Përdoruesit, tashmë gëzojnë përfitime nga më të ndryshmet, mirëpo nëse nuk jeni akoma përdorues i IBAS, shkarkoni aplikacionin dhe eksploroni shërbimet të cilat bëjnë jetën tuaj të përditshme, më të lehtë.

Shkarko aplikacionin këtu:

App Store: https://apps.apple.com/us/app/ibas/id1512391343

Play Store: https://play.google.com/store/apps/details?id=com.ibas.app

Këto janë ngjarjet më të fundit dhe shërbimet:

IBAS – Integrohet në SEPA (Single European Payment Area)

IBAS, themeluar jashtë Evropës dhe duke operuar jashtë saj, është institucioni i vetëm vendor në Ballkanin Perëndimor që integrohet në SEPA. Përmes këtij shërbimi, përdoruesit e IBAS mund të dërgojnë dhe pranojnë transferta ndërkombëtare brenda sekondave, me kosto shumë të ulët.

Individët: Tani të gjithë mërgimtarët që jetojë në vendet e Evropës, kanë mundësinë të dërgojnë para në Kosovë. Ky proces mundësohet nga bankat e juaja, duke zgjedhur transaksionin me SEPA, ju mund të dërgoni mjete në Kosovë për pak sekonda, me kosto shumë të ulët.

Bizneset: Përpos qytetarëve, kemi edhe bizneset të cilat operojnë në Kosovë dhe që importojnë mallra apo shërbime në vendet evropiane, që mund të përfitojnë nga ky shërbim dhe të bëjnë transferta ndërkombëtare të shpejta, me kosto të ulët, dhe të sigurta. Kostoja e transaksionit do të jetë vetëm 3 euro për çfarëdo shume.

BLEJ TANI, PAGUAJ MË VONË!

Përmes këtij shërbimi që IBAS ofron, ju bleni produktet sot, ndërsa paguani pas një periudhe kohore. Duke avancuar llogarinë tuaj në aplikacion, ju do të keni qasje në këtë shërbim, që ju ofron fleksibilitet në pagesat tuaja. Ju mund të bleni produktet që dëshironi dhe të përfundoni pagesën për një periudhë kohore deri në 12 muaj.

Mirëpo më e rëndësishmja është fakti që ju nëse shlyeni borxhin tuaj brenda 3 muajve, ju asnjëherë nuk do të paguani interes.

Andaj, fillimisht avanco llogarinë, zgjedh pakon, dhe shfrytëzo shërbimin.

Paguaj faturat ONLINE dhe me ZERO TARIFË!

Brenda aplikacionit, tek butoni “Pagesat Perodike”, ju mund të shihni se cilat pagesa apo fatura mund t’i përfundoni online, dhe përpos që lehtësoni procesin që duhet përfunduar çdo muaj, ju i përfundoni ato me shumë pak klikime brenda aplikacionit.

Mirëpo nuk është vetëm kjo, ju mund të përfundoni pagesën e këtyre faturave ONLINE me ZERO TARIFË: Energjia Elektrike, Uji, Mbeturina, Gjobat, Tatimi në pronë, Universiteti i Prishtinës, Ndërmarrka Publike Banesore, Kujtesa.

Dhe në fund, IBAS iu rimburëson të gjitha faturat, cdo dy javë.

CASHBACK

Zhvillimi i radhës në IBAS është edhe CASHBACK, që do të thotë që kur ju paguani përmes aplikacionit, në bizneset partnere të IBAS, ju fitoni BONUS 0.50% të shumës. Ju brenda aplikacionit mund të shihni të gjitha bizneset të cilat janë partner me IBAS, ashtu mund edhe të shihni ku mund të përfundoni pagesat.

Procesi pagesave është jashtëzakonisht i lehtë, ju përmes QR Code, i përfundoni pagesat tuaja dhe më pas fitoni BONUSIN.

IBAS – Avanco Llogarinë dhe zgjedh njërën nga PAKOT

IBAS ofron katërt (4) lloje të llogarive që përmbajnë shërbimin SEPA dhe shumë përfitime tjera, lexoni më poshtë:

Llogaria BAZIKE

- Llogari bankare britaneze;

- Mbushjen e kuletës suaj në IBAS përmes VISA ose Mastercard;

- Pranimi ose dërgimin e të hollave në dhe nga mbi 5,000 banka të Zonës Evropiane, përmes SEPA.

Llogaria PLOT

- Njëqind (100) euro pa interes për tre muaj, me qëllim të realizimit të pagesave tuaja;

- Llogari bankare britaneze dhe një (1) transfer hyrës ose dalës, pa pagesë (FALAS);

- Mbushjen e kuletës suaj në IBAS përmes VISA ose Mastercard;

- Pranimin ose dërgimin e të hollave në dhe nga mbi 5,000 banka të Zonës Ekonomike Evropiane, përmes SEPA.

Llogaria INTEGRA

- Dyqind (200) euro pa interes për tre muaj, me qëllim të realizimit të pagesave tuaja;

- Llogari bankare britaneze dhe dy (2) transfere hyrës ose dalës, pa pagesë (FALAS);

- Mbushje e kuletës suaj në IBAS përmes VISA ose Mastercard;

- Pranimin ose dërgimin e të hollave në dhe nga mbi 5,000 banka të Zonës Ekonomike Evropiane, përmes SEPA.

Llogaria PREMIUM

- Pesëqind (500) euro pa interes për tre muaj me qëllim të realizimit të pagesave tuaja;

- Llogari banare britaneze dhe tre (3) transfere hyrës dhe dalës pa pagesë (FALAS);

- Mbushje e kuletës suaj në IBAS përmes VISA ose Mastercard;

- Pranimin ose dërgimin e të hollave në dhe nga mbi 5,000 banka të Zonës Ekonomike Evropiane përmes SEPA.

Këto janë vetëm disa nga inovacionet që kemi ofruar gjatë këtij viti për përdoruesit tanë, kemi akoma dhe më shumë, andaj rrini të kyçur për më shumë informata dhe na ndiqni edhe në Rrjetet Sociale:

Instagram: https://instagram.com/ibas.world?igshid=MzRlODBiNWFlZA==

Facebook: https://www.facebook.com/ibas.world?mibextid=b06tZ0

LinkedIn: https://www.linkedin.com/company/ibas-world/

Commercial receipts, their types, advantages and disadvantages

What are commercial receipts?

A commercial paper is a short-term, unsecured debt instrument issued by businesses. It is usually used to finance short-term obligations such as wages, accounts payable, and inventory or goods for sale (Baklanova, et al., 2020).

The commercial receipt specifies an amount of money that must be returned by a certain date (maturity). The minimum value of commercial receipts is usually $100,000, while maturity or repayment terms range from 1 to 270 days (Baklanova, et al., 2020). On average, the turnaround time is 30 days (Hayes, 2022).

How do commercial receipts work?

The commercial paper was first introduced about 150 years ago, when New York merchants began selling their short-term obligations to brokers in order to have sufficient capital to cover short-term obligations.

Selling agents, or brokers, buy the paper (also known as a bill of exchange) at a discount from face value, otherwise known as the “Par” value. They then sold the paper to banks and other investors. Traders paid investors an amount equal to the face value. For example, they would take a commercial receipt for a few percent less and sell it for the value described on the receipt.

A commercial paper is not backed by any form of collateral, making it unsecured debt. It differs from asset-backed commercial paper, a class of debt instruments secured by assets chosen by the issuer (Hayes, 2022). However, it remains at the discretion of the parties to the transaction how they wish to handle and secure their contractual relationship.

In any case, commercial receipts are issued only by companies with high ratings from credit rating agencies (Hayes, 2022). These companies can find buyers easily, without having to offer a significant discount for issuing debt. Buyers of commercial receipts are usually other corporations, financial institutions and wealthy individuals (Baklanova, et al., 2020).

Types of commercial receipts

There are four types of commercial receipts: bills, drafts, checks, and certificates of deposit (CDs) (Hayes, 2022).

Bills of exchange

Promissory notes are debt instruments written by one party to another, promising to pay a specified amount of money by a specified date. Bills of exchange are a common way of issuing commercial receipts.

Drafts

A draft is a written agreement between three parties: a bank, a payee and a payee. The bank instructs the issuer of the commercial receipt to pay the lender (payee) a specified amount of money at a specified time. A draft is a written agreement between three parties: a bank, a payee, and a payee. The bank instructs the issuer of the commercial receipt to pay the lender (beneficiary) a specified amount of money at a specified time.

Checks

Checks are paid at the bank’s request, not by time. They are the fastest way to issue commercial receipts. For this type of commercial receipt, the issuing company instructs the bank to give the recipient a certain amount of money at a certain point in time.

Certificates of deposits

Certificates of deposit are monetary documents through which the bank claims to have received a sum of money deposited by an investor. The bank agrees to return this money as well as interest at a certain time in the future. The certificate specifies the interest rate and maturity date.

Advantages of commercial receipts

The main advantage of commercial paper is that they do not need to be registered with the Securities Exchange Commission (SEC), as long as the maturity does not exceed 270 days. This makes them a simple means of financing. Although maturities can take up to 270 days before entering the SEC’s jurisdiction, commercial paper maturities average about 30 days (Hayes, 2022).

The trade receipt is also easier to handle, compared to the effort, time and money involved in getting a business loan. It offers issuers the advantage of lower interest rates, while offering investors a low risk of default. Trading receipts provide an effective way of portfolio diversification.

Shortcomings of commercial receipts

Companies must have extremely good credit (credit) to issue commercial receipts. So, not all businesses have the option of issuing them. Furthermore, the proceeds from this type of financing can only be used for current assets or inventories. They are not allowed to be used for fixed assets without the involvement of the SEC (Hayes, 2022).

Low interest rates for issuers mean low rates of return for investors. Also, due to their considerable value, receipts tr

equity is not readily available to smaller investors. However, they can invest indirectly through companies that buy commercial paper.

Commercial receipts versus bonds

Both are debt instruments. However, there are important differences between them. Commercial receipts have a maturity of one to 270 days, while bonds have a maturity of one to 30 years (CFI Team, 2022)

The commercial receipt has no periodic payments. Everything is paid in one payment at maturity (Hayes, 2022), whereas bonds pay interest at regular intervals (Parker, 2022).

An example of a commercial receipt

Assume that a construction company is looking for short-term funds to finance the supply of construction material. The company needs 100,000 euros. It offers investors commercial receipts with a nominal value of 105,000 euros. When the commercial paper matures, investors receive an interest payment of €5,000 along with the €100,000 they lent. This is equivalent to an interest rate of 5%. This interest rate can be adjusted in relation to time, depending on the number of days for which the commercial receipt is unpaid (Outstanding).

Is a trade receipt a type of debt?

Yes. Commercial paper is short-term and (un)secured debt issued by institutions that want to raise the necessary capital for a short period of time. It is an alternative to taking out a business loan.

Who are the main buyers of commercial receipts?

Due to the considerable amount of emissions, the main buyers of commercial receipts are large institutions. According to the SEC, these institutions include: investment companies, retirement savings funds (Retirement accounts), state and local governments, financial and non-financial institutions (Baklanova, et al., 2020). Individuals can also be purchasers of commercial receipts.